Machine Vision Industry Update: Q3 Results and 2024 Growth Outlook

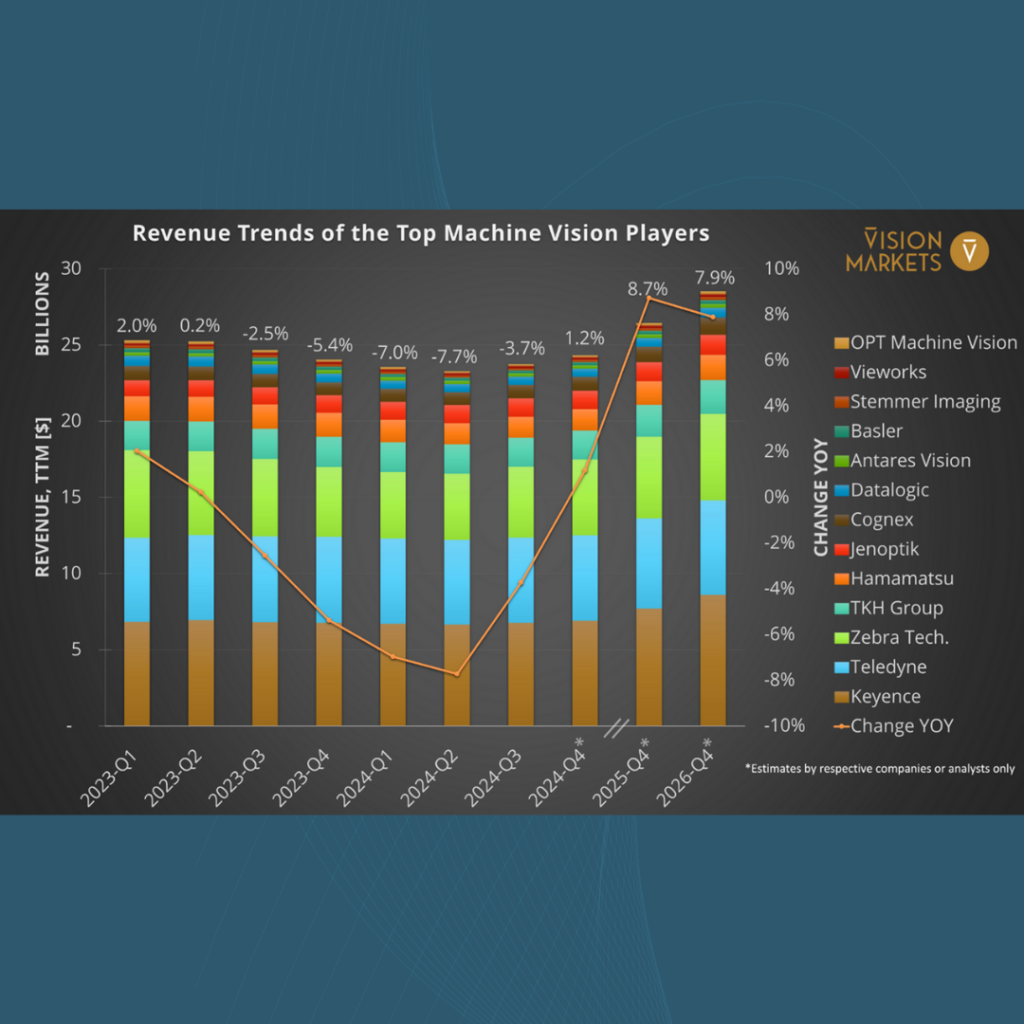

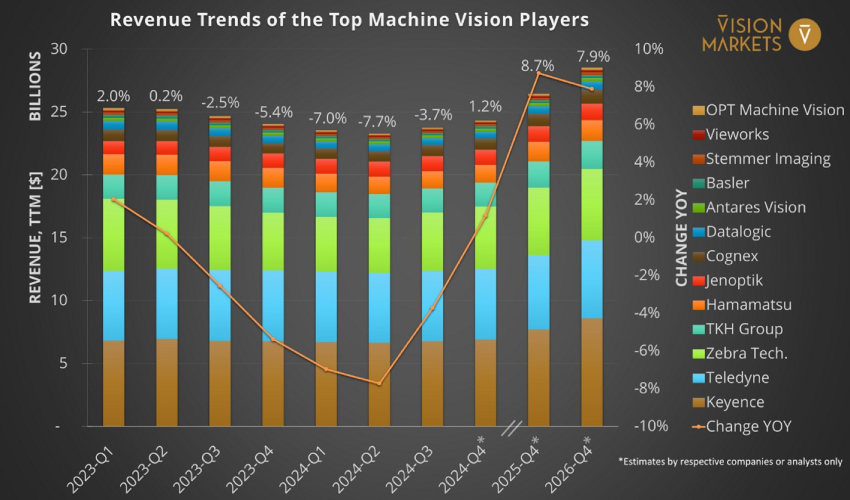

The current state of the machine vision industry, along with its primary target—industrial manufacturing automation—sets the stage. After a relatively stable 2023, revenues took a nosedive in Q1 and especially Q2 of 2024. Fortunately, Q3 showed some recovery, and the overall revenue growth for 2024 is expected to be just under 2.0%. Considering a strong US dollar, analysts are optimistic and forecast growth rates of around 8-9% for 2025 and 2026.

Basler took the hardest hit among publicly listed companies, with a year-over-year (YoY) decrease in its trailing twelve-month (TTM) revenue in USD of 28.1% in Q2. After weak Q3 TTM results in 2023, the revenue decline in Q3 2024 shrank to 16.8%. Their guidance for 2024 suggests a relatively soft landing at -5.9%, with a forecasted growth of 7.5% in 2025 and 13.4% in 2026. TKH Group’s 2D and 3D vision segment saw a moderate YoY decline in Q3 but predicts a strong Q4.

Component manufacturer and system provider OPT Machine Vision also experienced a 27.8% drop in Q2, with Q3 ending slightly better. For the whole of 2024, the company indicates a trend of just -3.2%, being under pressure from government-funded machine vision players in China, like many others are.

Stemmer Imaging, focused on Europe, saw a dip in Q3 with a 25.0% decline in TTM revenue. Meanwhile, heavyweights Zebra Technologies and Cognex, expect revenue growth rates of +8.3% and +8.1% in 2024, respectively, compared to a weak 2023 for both. Teledyne’s largest segment is Digital Imaging. The group forecasts its TTM revenue to be flat by the end of Q4 compared to 2023, despite inorganic growth. In contrast, Keyence is expected to grow by 3.6% this year and almost 12% in 2025.

Companies focusing more on vision solutions rather than components, such as Jenoptik and Antares Vision had very positive YoY growth rates in the first nine months of 2024 of up to 12% (TTM, YoY). Their guidance for the whole year shows +5.8% and just 1.1%, though. Reportedly, machine vision orders have already been picking up again, especially from the semiconductor sector and non-cyclical industries, with a regional focus on Korea and North America.

This chapter is an excerpt of our Q4 2024 Market Bulletin. Members of our #VisionCrunch community have received it weeks before its official publication. Join now and get your free copy here.

Don’t miss our future market updates!

Subscribe to our VisionCrunch business newsletter today!