Global Manufacturing Industry: 2024 Ends as Mixed Bag

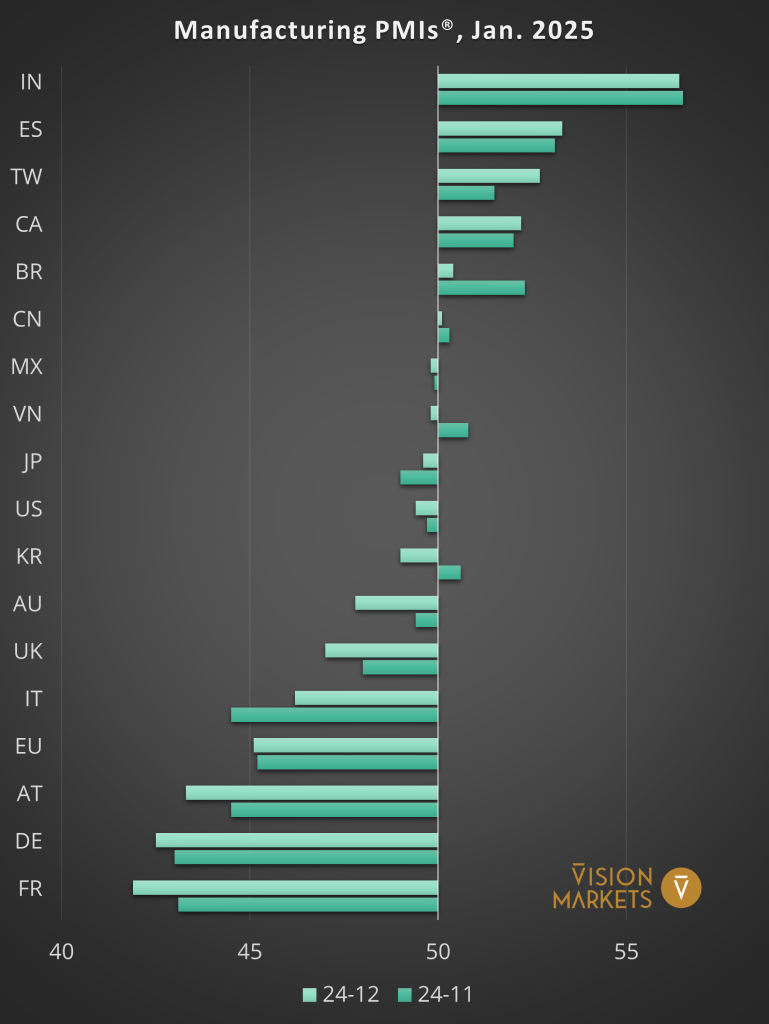

The latest Manufacturing PMI® data for December highlights a mix of resilience and challenges across key global economies (see figure 1). This creates a compelling scenario for Machine Vision suppliers to refine their regional sales and marketing strategies.

South Korea experiences a sharp decline of 1.6 points, slipping into contraction from mounting pressures of local rivals on its manufacturing sector. Japan, on the other hand, got a breather from its 3-month downward trend, improving to 49.6. Taiwan delivers the strongest upswing in the region, with a 1.2-point rise, moving further into expansion territory. We will see how China’s new initiative to hand out Chinese ID cards to Taiwanese citizens will weigh on the economic climate of the island.

Vietnam, however, slips into contraction, signaling challenges after months of stability.

Spain continues to outperform, with a slight improvement maintaining its position as the regional leader in Europe. Germany and Austria see modest improvements though both remain deep in contraction territory. France struggles further highlighting deepening economic challenges and political turmoil. Italy, while still in negative sentiment, shows less pessimism with a notable 1.7-point improvement.

Followers of our social media profiles and members of our VisionCrunch community, are already familiar with the economic indicators we use to monitor the manufacturing industry by country. If you are not, please check out this explanation of Manufacturing PMI and year-over-year change in Industrial Output.

Purchasing Managers’ Index™ and PMI® are either trademarks or registered trademarks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

In North America, the United States report a marginal decline reverting a steep M-PMI improvement since September. With Trump 2.0 and unforeseen changes in policies looming, manufacturers’ sentiment retreats from the 50-point line. Canada keeps rising signaling steady expansion. After the latest resignation of premier Trudeau the economic climate in Canada is expected to brighten. Mexico sees a minor decline of 0.1 points, hovering close to the neutral line. For the first time, we have included Brazil in our monitoring as it becomes increasingly important as target market for manufacturing automation. While the M-PMI decreases significantly by 1.9 points it remains above 50, indicating slower growth.

These trends emphasize the contrasting trajectories of global economies. Emerging markets like India and Taiwan lead the charge in recovery, while developed markets confront persistent challenges.

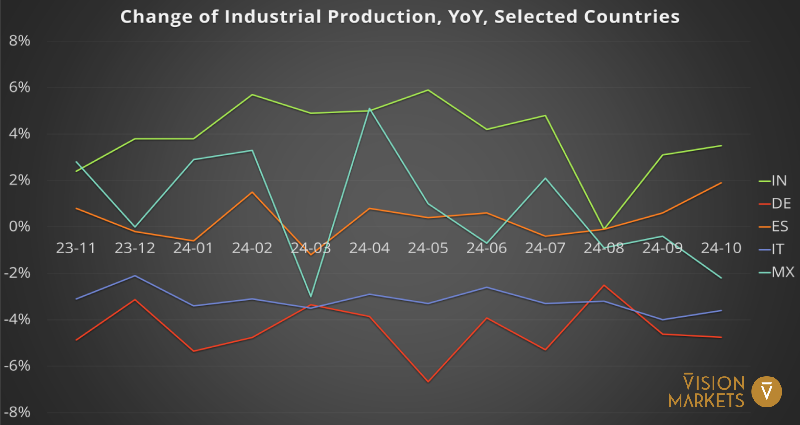

The year-over-year industrial production data for October (see figure 2) shows varied outcomes. The US shows a slight recovery but remains in negative territory, while the EU continues its decline, though less sharply. Japan rebounds to positive territory, and Korea surges with significant growth after prior struggles. China maintains robust growth above 5%, showcasing its resilience.

The year-over-year industrial production data (see Fig. 3) highlights India’s continued boom, showcasing strong growth and resilience among emerging markets. In contrast, Mexico faces deeper contractions, reflecting expected headwinds from Trump 2.0. Germany’s contraction deepens slightly, while Spain continues its recovery, climbing from 0.6% to 1.9%. Italy narrows its decline, reflecting some stabilization. These shifts reflect varied economic pressures and recovery trajectories across regions.

Structural challenges in developed markets like the EU and Japan remain a key concern, though Japan has rebounded to positive growth and the EU’s decline has moderated. The impact of Trump 2.0 on the US manufacturing economy is still uncertain, with the US showing slight recovery but remaining in negative territory.

We provide you with a dedicated page where you will always find the latest available readings of Manufacturing PMIs and the Industrial Output of the target countries of Machine Vision suppliers.

Don’t miss our future market updates!

Subscribe to our VisionCrunch business newsletter today!