Global Manufacturing Enters 2025 with Some Optimism

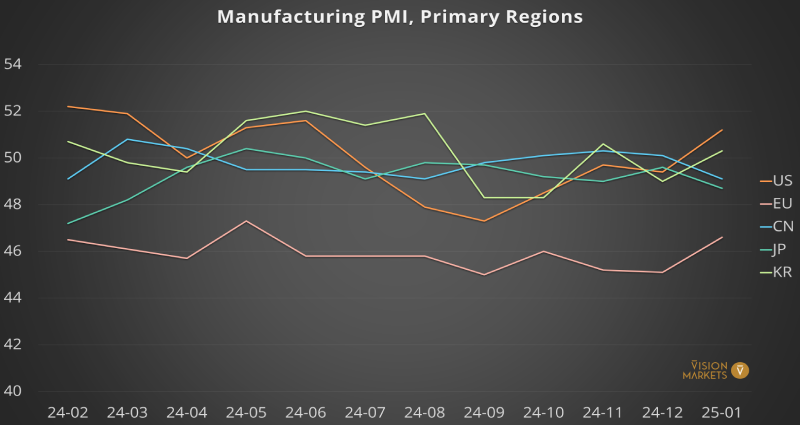

The primary target regions of industrial automation and machine vision entered 2025 in a notably better mood compared to the end of 2024. However, ‘better’ does not equal ‘good’ in most regions.

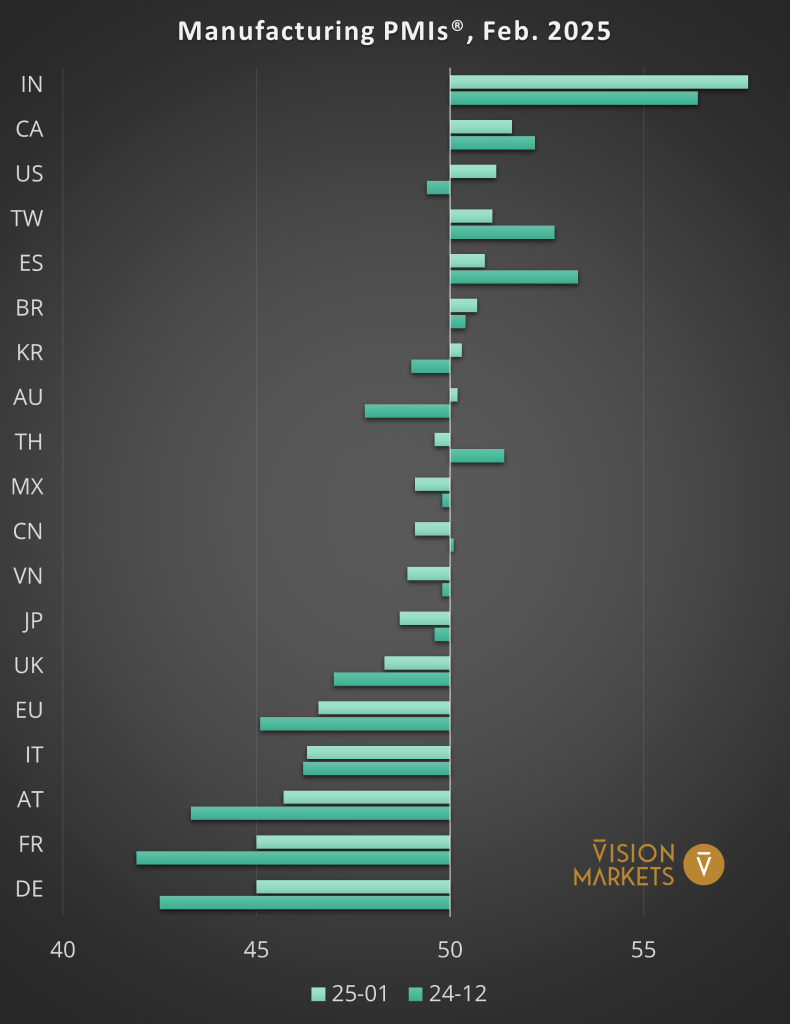

On a global scale, the latest Manufacturing PMI® ticked up to slightly above 50 points, signalling vague growth expectations over the previous month.

While purchasing managers foresee a slight decline in export orders – likely due to trade tariffs – the categories of Production Output and New Orders switched from modest contraction in December 2024 to slight growth in early 2025.

Followers of our social media profiles and members of our VisionCrunch community, are already familiar with the economic indicators we use to monitor the manufacturing industry by country. If you are not, please check out this explanation of Manufacturing PMI and year-over-year change in Industrial Output.

Purchasing Managers’ Index™ and PMI® are either trademarks or registered trademarks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

Europe

Starting our regional analysis with Europe, just three target industries of manufacturing automation report growth expectations in New Orders, namely (in descending order):

- Pharma & Biotech,

- Food & Beverages, and

- Construction Materials.

However, most manufacturing sectors in Europe show readings significantly below 50 for both, New Orders and Output (in ascending order)

- Metals & Mining with a devastating sentiment index for Manufacturing Output at below 38,

- Technology Equipment,

- Automobiles & Parts,

- Chemicals,

- Forestry & Paper Products, and

- Machinery & Equipment.

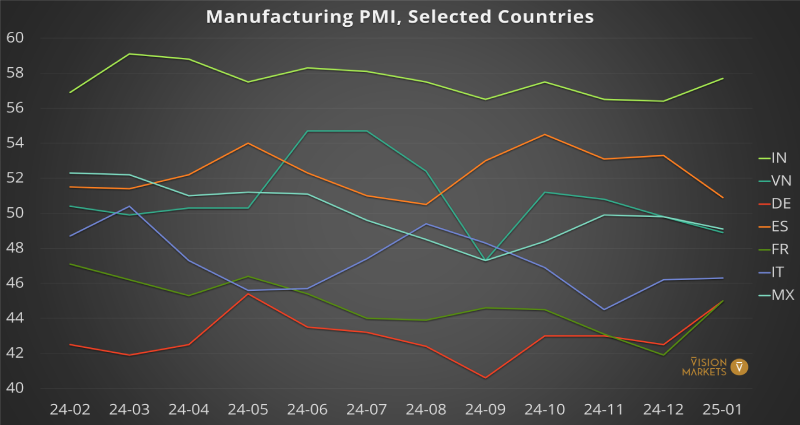

With an average M-PMI reading of just 46.6, the EU sentiment improved by 1.5 points over the end of 2024 but still sits deep in expectations of further recession. The manufacturing sectors of the major European economies – Germany, France, and Italy – show scores of 45.0, 45.0, and 46.3, respectively, indicating that the driving engines of Europe are fading away. Spain remains the only larger European economy with a positive outlook, despite a drop from 53.3 in December to 50.9 in January.

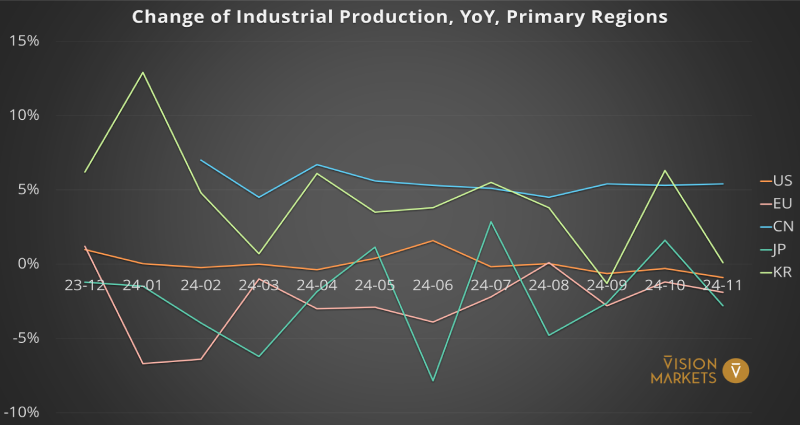

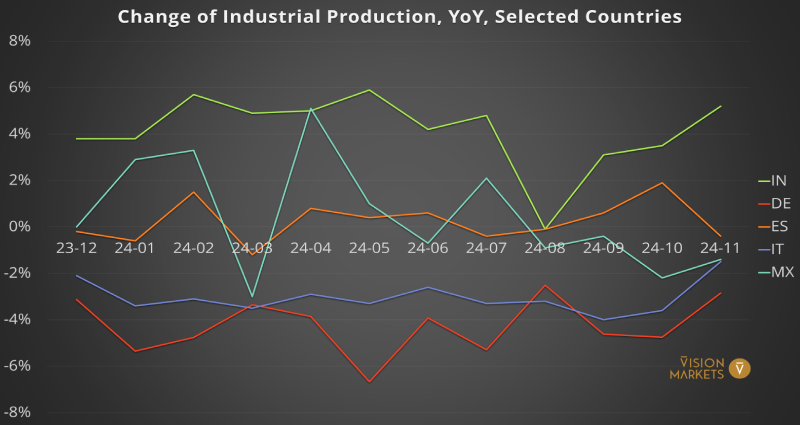

Looking at the latest numbers on the Industrial Production of the EU, November 2024 showed a continued year-over-year downturn by -1.9%, while Germany’s output fell by –2.85%. Economists hope for a revival of economy-oriented policymaking post Germany’s general elections and a new government in France. A recovery from the structural deficits of European countries as business locations is expected to take 3 to 5 years in the best case.

North America

The confidence level of the US manufacturing industry ticked up in January to 51.2 points, a recovery from 6 months in recession territory and its highest value since June 2024. Donald Trump’s inauguration is expected to provide impulses for the US industrial sector, leading to one of the largest monthly gains on record. The optimism came from both Output and New Orders, while New Export Orders continued to fall, albeit marginally. Retrospectively, the US Industrial Production fell year-over-year (YoY) by -0.9% in November but bounced up by 0.55% in December.

While confidence in the US got a boost in light of Trump 2.0, Mexican producers appear more worried about this development. The M-PMI of Mexico fell to 49.1, constituting its 7th month in recession sentiment. Canada, at the same time, defended its 2nd position among growth-expecting industrialized nations with a reading of 51.6. The imposed, paused, and looming tariffs by the Trump administration induce uncertainty for industrial players, especially outside of the US, and fuel USD inflation. Read more about the “9 implications of Trump 2.0” in our latest market bulletin.

Asia

India remains the rising star of the global manufacturing sector with a sentiment score at a 6-month high of 57.7. In November 2024, the Industrial Production output ticked up to 5.2%, continuing a 2-year streak of growth with a slight exception in August 2024.

The looming trade war between the US and China pulled the Chinese M-PMI into contraction territory, down to 49.1 points. While China’s M-PMI readings meandered between 49 and 51 points throughout the last 12 months, the Chinese state offices report a remarkably strong and stable YoY trend in Industrial Production between 4.5% and 6.7% throughout 2024. The discrepancy between the sentiment score and the government-reported figures fuels doubt about the accuracy of the official data.

Korea’s Manufacturing PMI edged back up to 50.3 in January from 49.0 in December. The uptick is almost parallel to the US’s M-PMI, related to hopes that Korea will benefit from an upswing in the US, fueling consumption of cars and electronics. Meanwhile, Japan’s index dropped to 48.7, the lowest reading since April 2024, continuing the recession sentiment throughout the second half of last year.

The ASEAN manufacturing sector started 2025 on a softer note but remains optimistic with an overall score of 50.4. While manufacturing demands are slightly slowing down, backlogs continued to rise, indicating increasing pressure on capacity and thus increasing demand for automation.

Taiwan’s manufacturers are less bullish in light of China starting to hand out Chinese ID cards to Taiwanese citizens, increasing the likelihood of an invasion. Also, the sentiment of manufacturers in Vietnam came in lower at 48.9. In Thailand, the latest addition to our M-PMI monitoring, confidence dropped remarkably from an optimistic 51.4 reading in December to a slightly pessimistic 49.6.

The industrial sector of several advanced economies saw notable improvements in their sentiment scores considering the beginning of Donald Trump’s second term. Over the first couple of weeks, Trump did not hold back with announcements and threats that could have far-reaching geopolitical consequences. The trade war with China was re-started, and it remains to be seen how many rounds this fight will go and who will come out advantageously, if anybody.

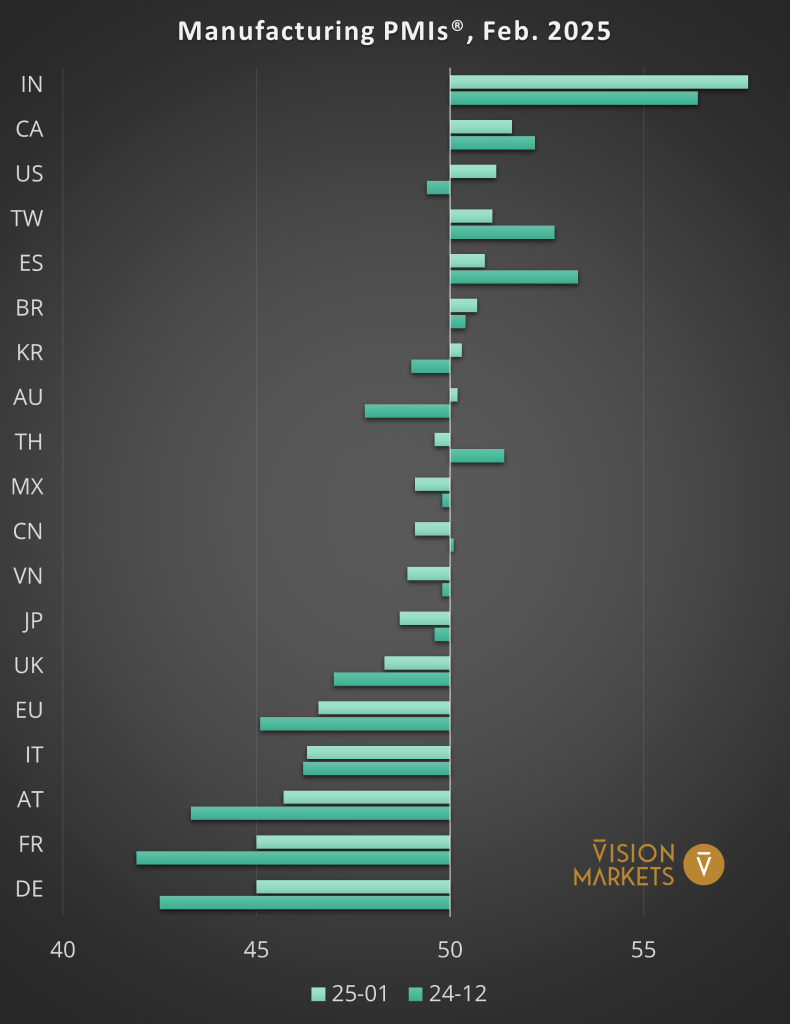

To allow for some retrospective, we also offer the Manufacturing PMI readings of the last 24 months. Again, for better readability, we separate the charts into primary target regions of machine vision and selected countries. The charts show the indicator readings for the last 24 months.

If you would like to learn more about our perspective on the global target markets of Industrial Automation and Machine Vision, please contact us.

We provide you with a dedicated page where you will always find the latest available readings of Manufacturing PMIs and the Industrial Output of the target countries of Machine Vision suppliers.

Don’t miss our future market updates!

Subscribe to our VisionCrunch business newsletter today!