Automation Industry Defies Manufacturing Recession

Industrial Production Trends: Drop in Korea, Uptick in China

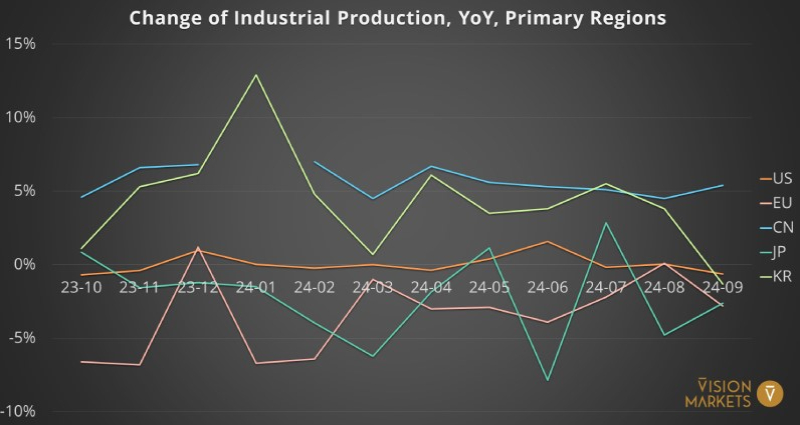

Figure 1 shows the mostly flat trend of industrial production in the US over the latest available 12-month period from September 2023 to August 2024. During the same period, the EU and Japan reported some steep declines, while China and Korea were cruising above 4% for most of 2024. In light of political instability and strengthening Chinese competition, Korea fell abruptly into recession territory in September, together with Korea’s Manufacturing MI (see figure 2). However, Figure 2 shows a recovery of the sentiment among Korea’s manufacturers in November.

Manufacturing MIs: Recovery in Korea, Drop in the EU

As a leading indicator, the manufacturing MIs were also in recession territory, below 50 points, for the primary regions targeted by automation and machine vision equipment. The sentiment among producers in the European Union has been lagging other regions for over two years, especially dragged down by a tough economic climate in Germany. Yet, in November, Italy and France saw major drops in their manufacturing MI readings that drove the decline of the EU.

On the other hand, US manufacturers were optimistic through the first half of 2024, but the score dipped below the 50-line from July onwards. Even the growth-spoiled Chinese manufacturing industry did not contribute to better readings as it was lagging behind the government-set target of a 5% annual increase. The Korean manufacturing sector, driven by its strengths in semiconductors, automotive, and defence, saw its sentiment drop in September as Chinese car manufacturers gained global market share.

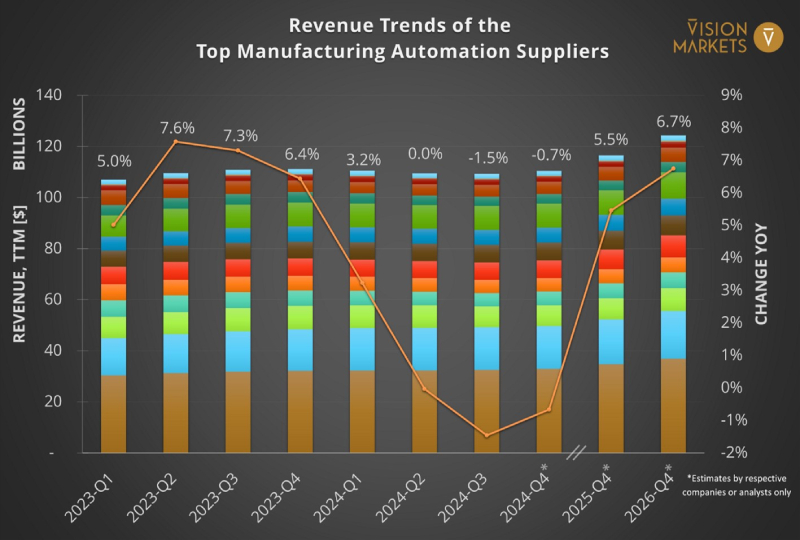

The TTM revenues of the 14 major manufacturing automation suppliers analyzed here aggregate to approximately $110 billion. The trend for 2024 is flat, showing much less volatility compared to the machine vision space.

However, company performances vary significantly depending on geographic focus and industry exposure. Companies like B&R-owner ABB and Atlas Copco, which owns ISRA Vision, Photon Focus, Quiss, and Vision Tools, see growth rates between 2.5% and 4%. Meanwhile, US and Japanese heavyweights Rockwell Automation and Omron anticipate declines between 10.8% and 8.0%.

Looking ahead, analysts expect these players to recover with moderate growth rates between 5% and 7%, though regional and industry-specific performance differences will persist.

This chapter is an excerpt of our Q4 2024 Market Bulletin. Members of our #VisionCrunch community have received it weeks before its official publication. Join now and get your free copy here.

Don’t miss our future market updates!

Subscribe to our VisionCrunch business newsletter today!