Global Manufacturing Industry: Disparity on the Rise

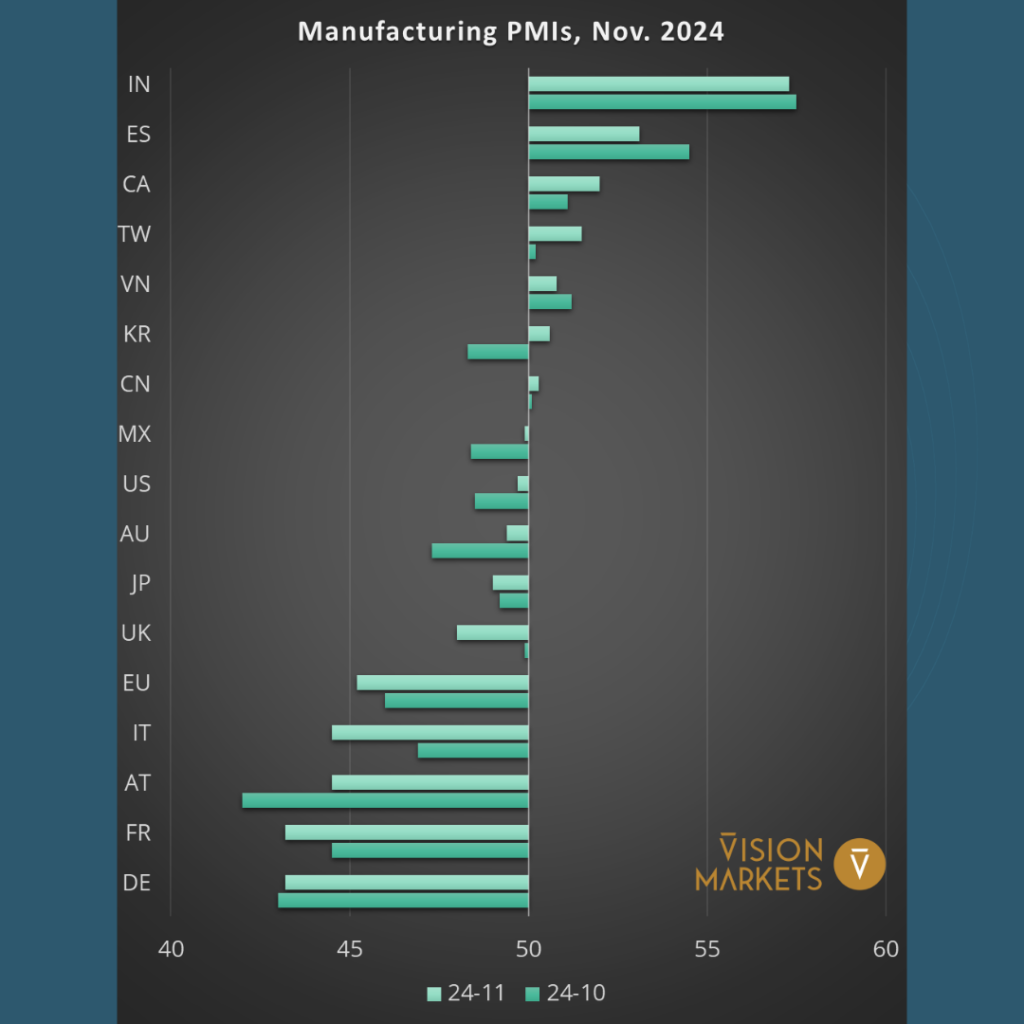

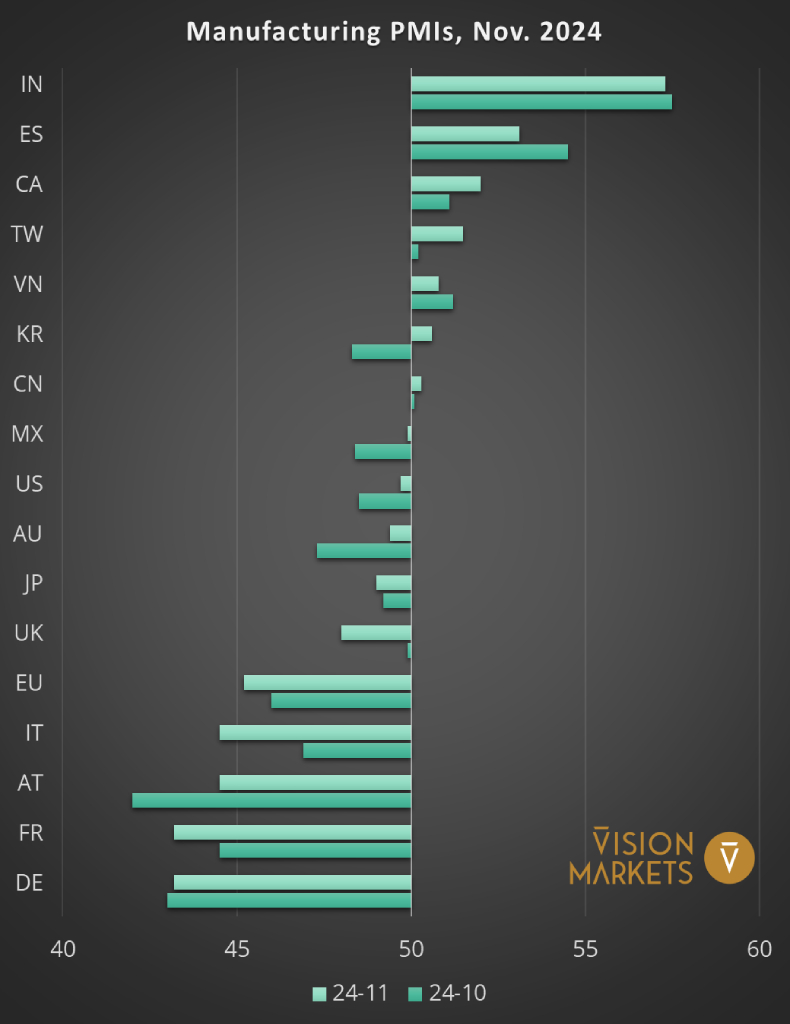

The Manufacturing PMIs for November reveal mixed signals across key global economies (see Fig. 1). Hence, Machine Vision suppliers are even more urged to set a clear regional focus in their sales and marketing strategy.

India has sustained its dominant position, showing robust growth, while Spain continues to outperform within the European Union. Vietnam’s PMI remains above the 50-line after rebounding to growth territory in October, further indicating further stabilization from the slowdown observed in September.

Meanwhile, Korea bounces back by 1.9 points into growth sentiment. China’s November PMI keeps indicating a stabilization which historically meant a growth of around 5%.

Followers of our social media profiles and members of our VisionCrunch community, are already familiar with the economic indicators we use to monitor the manufacturing industry by country. If you are not, please check out this explanation of Manufacturing PMI and year-over-year change in Industrial Output.

In North America, the United States have reported a much less pessimistic sentiment following Donald Trump’s victory in the presidential election. Also, Mexico showed marginal improvements in their PMI readings. However, both economies remain entrenched in contractionary territory, struggling to regain consistent momentum.

Germany and Austria have interrupted their prolonged declines, but their PMI readings are still among the lowest in Europe, reflecting persistent political and economic headwinds. The sentiments in Italy and France got a special hit in November where France approaches German levels and also Italy’s value dropped below 45, dragging down the overall reading of the EU.

While global PMIs show pockets of resilience, the broader manufacturing recovery remains fragile, with developed economies lagging behind emerging markets in momentum. The months ahead will determine if these economies, especially the EU, can overcome structural challenges and regain growth traction.

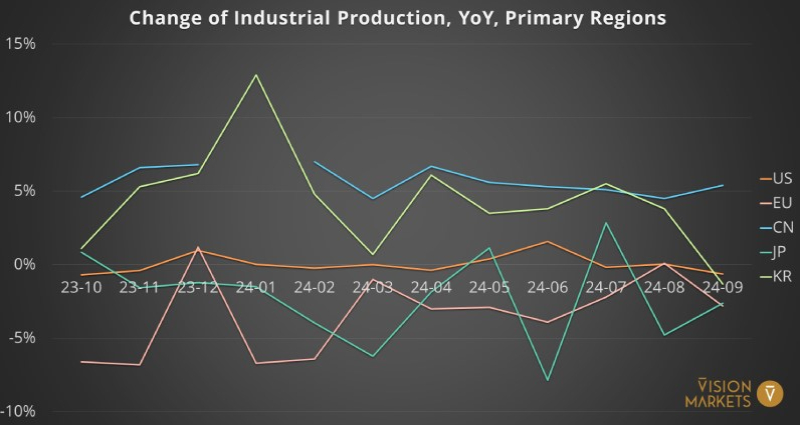

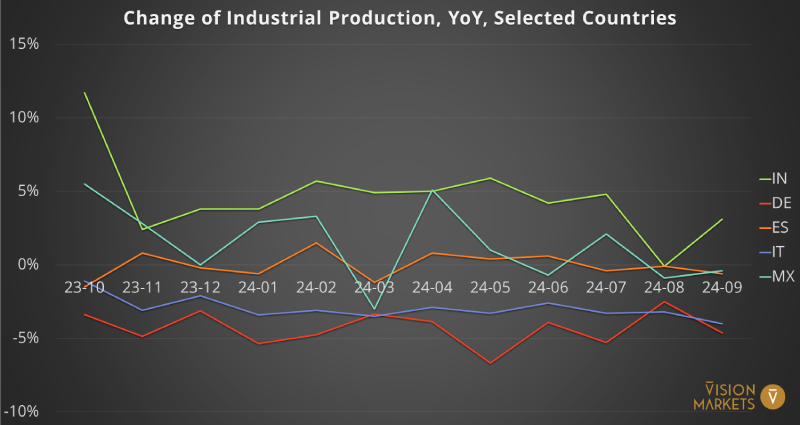

The year-over-year changes in industrial production outputs for September are now available. Figure 2 shows a mostly flat trend of Industrial Production in the US over the latest available 12-month period from October 2023 to September 2024. During the same period, the EU and Japan reported some steep declines, while China and Korea were cruising above 4% for most of 2024. In light of political instability and strengthening Chinese competition, Korea fell abruptly into recession territory in September together with Koreas Manufacturing PMI (see figure 1).

India has returned to significant growth after a brief pause, reinforcing its position as a strong performer among emerging economies. Conversely, Mexico faces further contraction, deepening its recessionary trajectory. Germany’s industrial decline has accelerated in September again while economist do not see a recovery from recession before 2026.

Manufacturing PMI readings signal broad improvement across several key economies, Italy and France are major exceptions.

We provide you with a dedicated page where you will always find the latest available readings of Manufacturing PMIs and the Industrial Output of the target countries of Machine Vision suppliers.

Don’t miss our future market updates!

Subscribe to our VisionCrunch business newsletter today!