Global Manufacturing PMIs

We have seen a stunning market growth over the past 10 years in manufacturing automation equipment, such as Machine Vision systems. This growth was fueled by the need for increased production speed, quality, and yield. Even in pre-Corona times of a slowing global economy, Industrial Manufacturing remained one of the key target markets of Machine Vision. Once Covid-19 related shutdowns of factories are released, we expect this application area to bounce back resulting in peaks of demand for Machine Vision equipment.

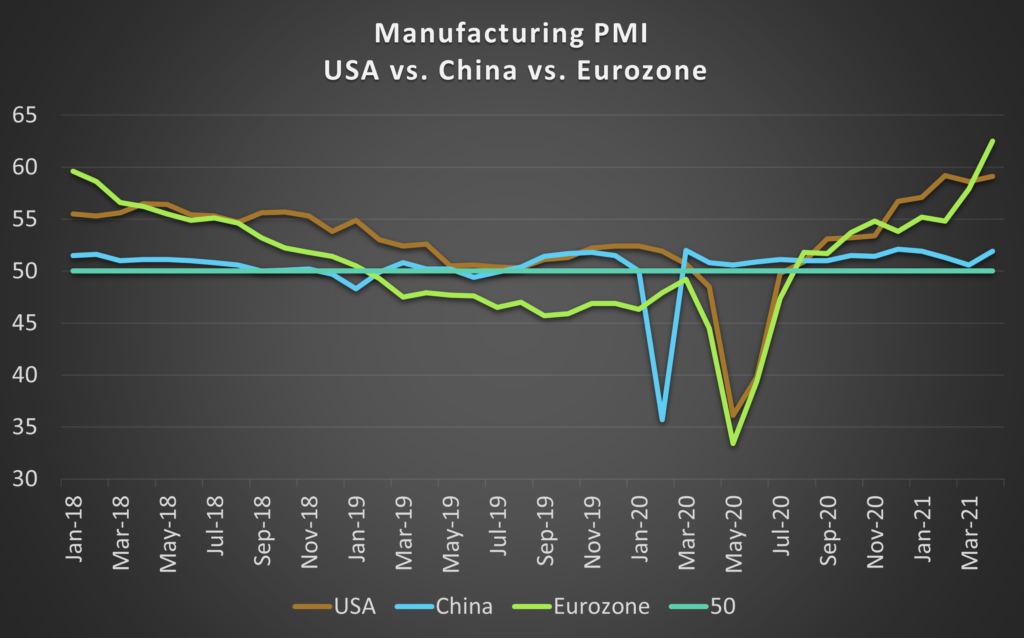

The Manufacturing PMI is a leading indicator of the direction and the rate of change in the industrial automation market.

April’21 Update: Eurozone and US manufacturing set to fast recovery

Europe is entering lockdowns in light of a third Corona wave, while the US economy is fighting shortages of supply to answer the steep recovery in demand from consumer goods over logistics automation equipment to manufacturing and construction equipment. Nonetheless, Europe’s Markit Manufacturing PMI came in at 62.5 which is an all-time high since its first polling in 2008. The reading for the US stays in the high-growth area just short below 60 as it did since December 2020.

In the short term and – with the announcement of a $4,000 billion strategic investment package by the US government – also in the long term, the economic perspectives for the North American Machine Vision market are better than for the Eurozone, where the recovery to a pre-pandemic level in manufacturing output is not seen before mid to end of 2022.

With a value of 51.9, China shows expectations of even further accelerated growth. This 1.3 increase constitutes the first positive change of April over March since 2018.

Machine Vision vendors with a focus on the North American market or on clients with a strong footprint there can benefit from the increased demand.

This is the time to

- review your go-to-market strategy,

- grow your sales staff in North America,

- enhance your marketing communication for the US and Canada

About Manufacturing PMIs

The Manufacturing PMI (Purchasing Managers’ Index®) is calculated monthly based on surveys polled from manufacturing company managers about new orders, production, employment, supplier delivery times and stock levels. The survey features the same questions about the same items in all countries and regions, allowing for a valid comparison across the globe. All answers are factored into an overall reading between 0 and 100 points. A reading above 50 indicates expansion in the sector, below 50 indicates decline. The market research firm IHS Markit provides the Manufacturing PMIs, often in collaboration with other research firms for specific markets.

Covered Regions

- Eurozone: monthly updates with an individual look at the top 5 countries, i.e. Germany, France, Italy, Spain, The Netherlands

- United States: monthly updates

- China: monthly updates

- Japan, South Korea, Australia, India, and further countries of the G20

How to Use Manufacturing PMIs for your Machine Vision Business

At Vision Markets, we use the Manufacturing PMI as one of several indicators to forecast the trend of the Machine Vision market in its primary target regions, i.e. Europe, North America, and China, as well as Japan and South Korea.

The monthly updates of the Manufacturing PMIs below shall support Machine Vision players to

- Define and adjust your forecast of sales turnover in the industrial automation market per region

- Set the right priorities and adjust the spendings for your marketing campaigns in industrial automation per region

- Focus your direct sales efforts and sales channels on the right regions depending on your business strategy

How to Benefit from our Expertise

Do you want to be notified about all updates on Manufacturing PMIs and other key business news for the Machine Vision market? We invite you to join the VisionCrunch community for the optimal development of your Machine Vision business!

Would you like a detailed analysis of your short- and long-term business potential with different target customer groups and regions? We are happy to define and implement the optimal strategy tailored to your business.

Set yourself up for growth and contact us now!

July’20 Update: Signs of recovery after deep decline

Driving the overall upturn in the euro area manufacturing economy during July were returns to growth in both production and new orders. The survey shows improved demand from both domestic and international markets. New export orders rose for the first time since September 2018.

Looking ahead to the coming 12 months, business confidence continued to recover in July, rising from June to its highest level since January. Firms are hoping that the recent positive trends in activity and new work will continue with a broader recovery from the pandemic.

Output and new orders both rise at the fastest rates for 9.5 years.

Companies registered the quickest expansions of output and new orders since January 2011 amid reports of firmer customer demand. Companies were generally confident that output would be higher than current levels in 12 months’ time. Growth forecasts were underpinned by expectations that economic activity and client demand will continue to recover from the pandemic.

The lockdown lead to empty shelves in U.S. consumer electronics stores due to increased consumer demand for home entertainment products. In U.S. and Europe, B2B demand for home-office equipment surged. Thus, makers of manufacturing equipment for semiconductors are reporting record sales numbers for H1 2020 with correspondingly positive effects for Machine Vision component suppliers.

The supply and demand sides both improved, with relevant indicators maintaining strong momentum. However, there still is the need to pay attention to the weakness in both employment and overseas demand across multiple sectors.

July’20 Update: U.S. Manufacturing PMI posted 50.9 at the start of the third quarter

Reflecting on the reopening of many customers, new orders increased for the first time since February in July. The rate of growth was modest, despite signaling a stark contrast to the marked decline seen in April.

The U.S. raises over the crucial mark of 50, but stays behind Europe and China in July 2020 and therefore reflects the course of the pandemic.

May ’20 Update: Expected drop for all western Manufacturing PMIs – China bounces back to pre-Corona trend

The Manufacturing PMI dropped significantly to a low-point in a decade in UK, USA, and the Eurozone. Manufacturing production, new orders, and employment all contracted at the fast rates, while vendor lead times lengthened to the greatest extent so far. The global pandemic also hit overseas demand, leading to a series-record drop in new export business.

One aspect of the Manufacturing PM Index is the buying activity of manufacturers, which registered a sharp downturn in April reflecting reduced demand. This corresponds with a notable decrease in fuel prices and a drop in demand for semi-finished goods.

In China, the manufacturing output continues to recover, albeit at a mild pace. The sharp plunge in export orders seriously hindered China’s economic recovery in April, although businesses were gradually getting back to work. Amid the second shockwave from the pandemic, the problems of low business confidence, shrinking employment, and large inventories of industrial raw materials became more serious.

March ’20

Update: Purchasing Managers in the US and Europe withstand the Coronavirus – Even in China Business Confidence rises

In China travel restrictions due to the coronavirus lead to a sharp deterioration in supply chains. The Caixin China Manufacturing index declined significantly down to 40.3 in February as production declines at a record pace as factories shutdown. This results in a record fall in output, new orders, and employment. This is an even weaker number than in November 2008 amid the global financial crisis.

Business confidence rises on hopes of output recovering.

Purchasing managers in the US and Europe withstand Covid-19 so far. The business confidence in the US is the strongest since April 2019 and therefore the PMI with a value of 50.7 just stays in the zone of growth a little lower than in January (51.9).

In the Euro Area, the PMI even rose to its highest value in twelve months.

As the data collection has been done till 21 February 2020 the impact of the coronavirus is still moderate. Due to significantly longer delivery times, companies are increasingly using inventory.

There is concern that the delivery delays caused by coronavirus could slow production in the coming months. Even if numerous Chinese companies resume production after the extended New Year’s holiday and the global supply bottlenecks weaken again, any escalation of the Covid-19 epidemic threatens to increase risk aversion and restrict investment in the business and consumer side.

Manufacturing PMI United States, Jan. 2020:

Hint to weakened business investments

The latest Manufacturing PMI numbers for January indicate a reduced optimism among the purchasing managers of the US manufacturing sector. As new export orders fell, the PMI drops slightly from 52.4 in December to 51.9. Yet it stays solid over 50 indicating continued growth of USA’s production output, especially for consumer goods.

Noteworthy for Machine Vision suppliers, there are hints towards weakened business investment as the production of capital goods such as business equipment, plant equipment and machinery fell for the first time in almost four years.

Manufacturing PMI, Eurozone, Jan. 2020:

Continued Decline at a Slower Rate

Operating conditions in the manufacturing economy of the Euro Zone continued to weaken at the start of the year, but at a notably slower rate. The Eurozone Manufacturing PMI registered 47.9, slightly better than December’s 46.3.

Although the index has now recorded below the crucial 50.0 mark for 12 months, the latest number was the highest since April 2019. This comes from slower falls in output, new orders, and purchasing, while business confidence improves during January to its highest level in 16 months.

The intermediate and investment goods sectors both continued to contract. The hoped-for turnaround towards an overall growing manufacturing output and thus growing investments into manufacturing equipment, such as machine vision systems, is not yet to be expected.

Strong competition and decreasing market size in the Eurozone require machine vision players to invest in highly focused marketing and sales initiatives as well as application-targeted innovations to facilitate growth in such market conditions.

Manufacturing PMI, China, Jan. 2020:

Light at the End of the Tunnel Despite Nominal Decrease

Manufacturing PMIs from all over the world showed a slight increase in most national manufacturing sectors across the globe compared to December 2019.

Only China’s Manufacturing PMI fell from 51.5 to 51.1 but remains in the growth-indicating space above 50 points. Despite its decrease, signs are positive for the Machine Vision industry as business confidence improves amid easing trade tensions. Production and new orders both expanded at soft rates.

The five-months low of the Chinese Manufacturing PMI mainly comes from falling employment which is considered as an attempt to reduce production costs.

The outlook stays positive as the Manufacturing PMI stays solid above 50. After a very sluggish 2019 for Machine Vision players in China, this is a positive indicator supporting our forecasted increase of Machine Vision turnovers for Q1 2020 on a low single-digit level.

Japan’s Manufacturing PMI, Dec 2019: Factory Activity Contracts at a faster pace

The Manufacturing PMI came in at 48.4 on a seasonally adjusted basis, matching a more than three-year low last touched in October 2019 and .5 points lower than November’s final reading of 48.9. No signs for an imminent turnaround.

As this number is even lower than expected the index should be taken as bearish for Japan’s manufacturing sector.