Webinar Recording: The Next Generation of Machine Vision Cameras

On November 25, 2025, industry experts explored the future of imaging technology – from breakthroughs in image sensors and processors to advances in interface standards and system integration.

Vision Markets Turns 10: Guiding the Machine Vision Industry Through a Decade of Change

Vision Markets is celebrating its 10th anniversary this year. Today, Vision Markets has become a trusted partner for over 130 businesses worldwide, helping clients navigate both rapid growth and unprecedented disruption in the imaging industry.

Global Manufacturing: Fading tariff boost reveals underlying weakness

The market environment for machine vision has slightly brightened in June 2025 as the US showed strong recovery driven by new orders and domestic demand. The Eurozone continued to contract. China returned to growth and South Korea faced subdued conditions.

Global Manufacturing: U.S. points up, Germany at a 34-month high

The market environment for machine vision has slightly brightened in June 2025 as the US showed strong recovery driven by new orders and domestic demand. The Eurozone continued to contract. China returned to growth and South Korea faced subdued conditions.

Mark Williamson joins Vision Markets consulting team

British machine vision experts brings in long track record in sales and business development in the machine vision industry.

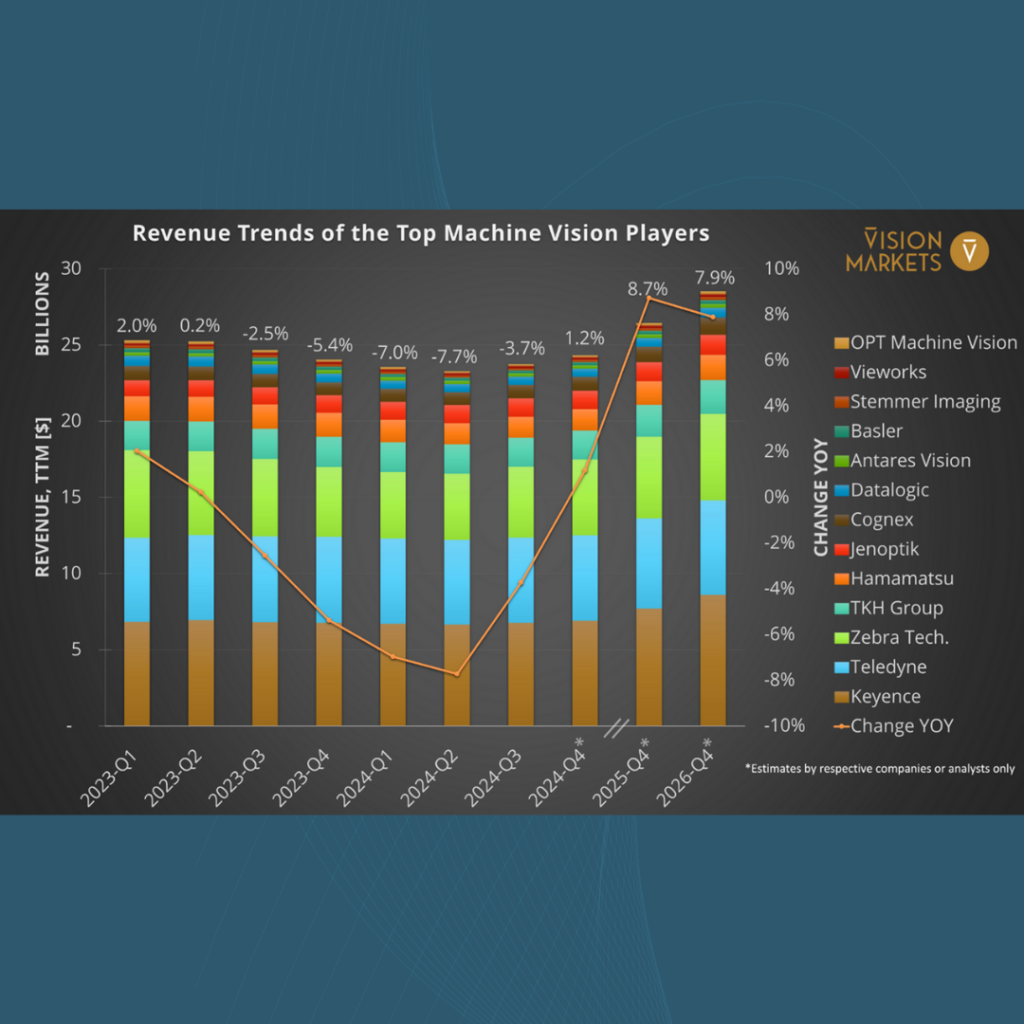

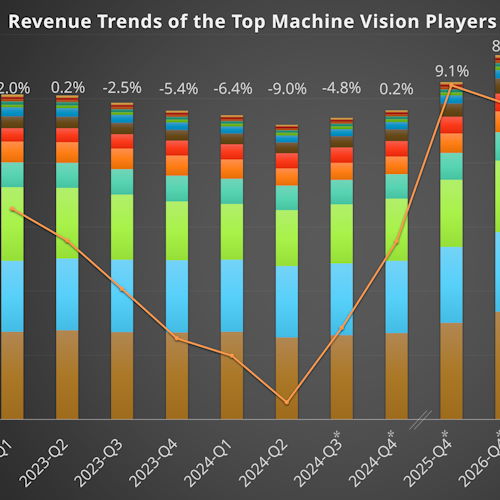

Machine Vision Industry Update: Q3 Results and 2024 Growth Outlook

The machine vision industry shows uneven 2024 recovery, with solution providers leading and stronger growth forecasted for 2025-26.

Top Machine Vision Players Project Business Acceleration in H2-2024

Despite a sharp slow-down in Q1 and Q2 2024, most stock listed machine vision players are still majorly positive about the second half of the year.

Economic Indicators by Target Regions of Machine Vision Suppliers

Find the latest economic indicators of the manufacturing industry in the target countries of machine vision suppliers. Updated monthly so you can stay knowledgeable of the trends in your different target regions.

Top-13 Machine Vision Players: Their 12-Month Revenue Trends

Find the latest economic indicators of the manufacturing industry in the target countries of machine vision suppliers. Updated monthly so you can stay knowledgeable of the trends in your different target regions.