Stalled in Uncertainty – the Machine Vision Market in H1 2024

In a year marked by general elections in over 100 countries, including 8 of the 10 most populous nations, global political dynamics are in flux. The United States faces significant political turmoil ahead of a pivotal election. Concurrently, two active war zones and heightened tensions around Taiwan, the Philippines, and Korea add to the global instability. Central banks worldwide are navigating perfect storms, balancing financial systems in acute imbalance with the conflicting needs of the real economy.

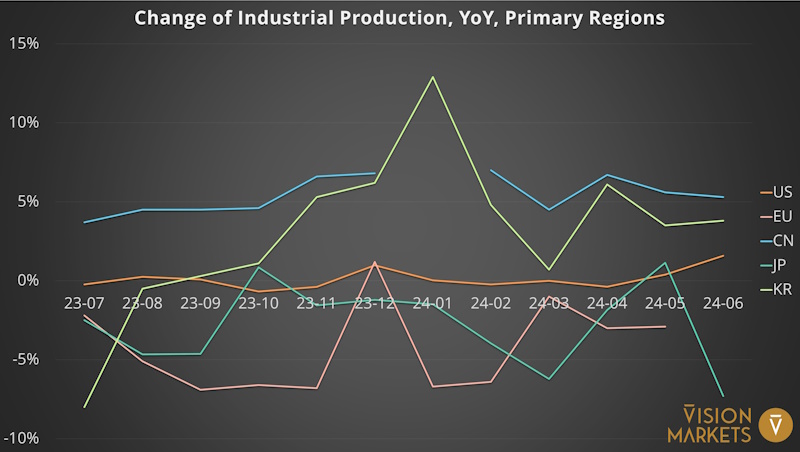

2024 was anticipated to be challenging for leading economies, particularly the industrial sector and hence the Machine Vision industry. However, the recession in the manufacturing sectors of the EU and Japan has proven to be more prolonged and severe than expected. Additionally, the increase in production output, reported by Chinese official authorities, no longer benefits Western OEMs as it once did.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. The author is not a registered investment advisor and is not affiliated with any brokerage or investment firm. Investing in the stock market involves risk, including the loss of principal. Readers should conduct their own research and consult with a financial advisor before making any investment decisions.

But let’s examine the key regions individually. Followers of our social media profiles and members of our VisionCrunch community are already familiar with the economic indicators used to monitor the manufacturing industry by country, as mentioned below. If you are not part of these groups, please refer to the section About our Indicators and Regional Market Segmentation in an earlier market update.

United States and Mexico

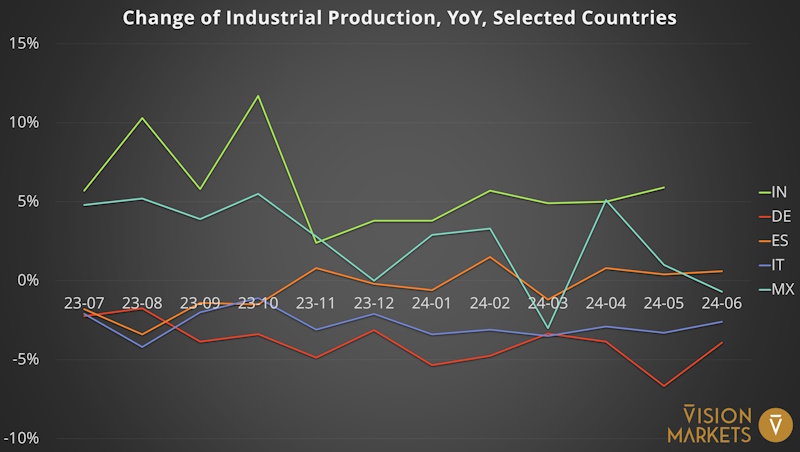

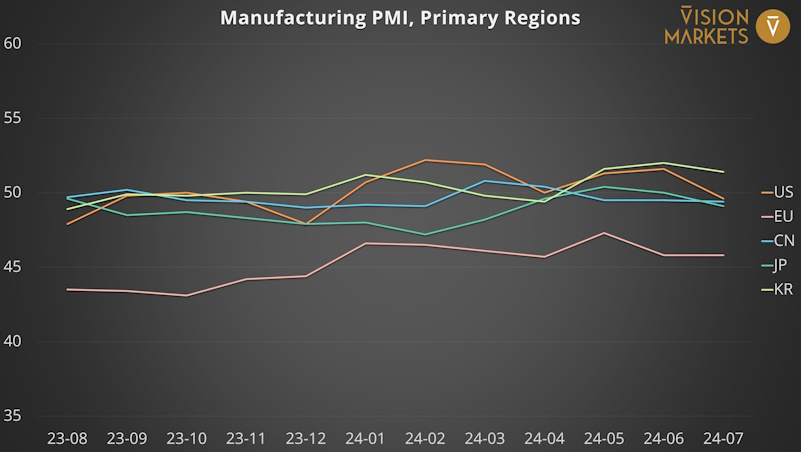

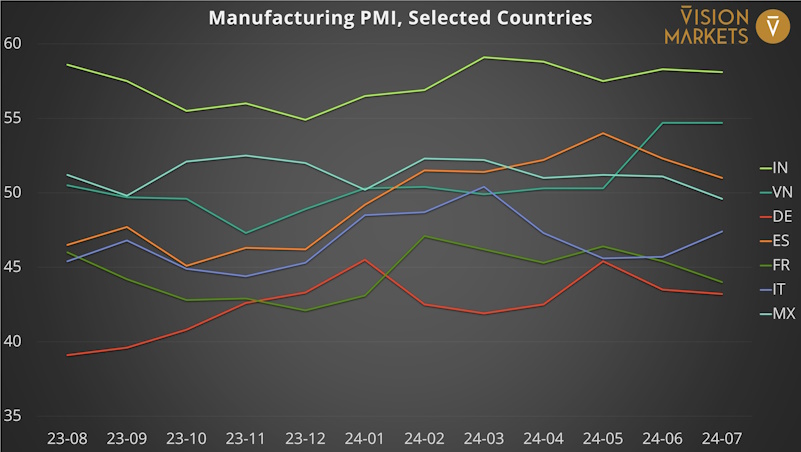

In June 2024, the US industrial production (light-orange line in Fig. 1 and Fig. 3) accelerated to the highest year-on-year growth rate since December 2022. The reading of 1.58% is still marginal but exceeds the H1’24 average of 0.23%, while June 2023 was also slightly above stagnation. Will this trend continue? Unfortunately, the July Manufacturing PMI for the US suggests otherwise, with a contraction reading of 49.6, coincidentally equal to Mexico (cyan line in Fig. 2 and Fig. 4). The Mexican Manufacturing PMI managed to stay in non-contracting territory throughout H1’24, although the year-on-year manufacturing output displayed high volatility, averaging 1.43% with a range from -3.0% to 5.1%.

The Biden administration released two major acts in 2022, totalling $400 billion in tax credits, loans, and grants, to bring manufacturing back to the US and decouple from China. However, a recent investigation revealed that approximately 40% of the projects funded by these acts have been delayed until after the November presidential election or paused indefinitely. The reasons are manifold:

- Expected interest rate cuts by the Fed have been postponed to September/October 2024, making current investments unattractive.

- Slower-than-expected demand for electric vehicles has led auto producers to delay expanding their production capacity.

- China produces more EV batteries and about twice as many solar panels as global demand, causing eroding prices and unattractive investments in these sectors.

- Some tax credit rules remain unclear, and Donald Trump has announced plans to cut down on such acts, leading to uncertainty and stalled investment activity, at least until November 2024.

The US government debt recently surpassed the $35 trillion mark. The unemployment rate rose for the fourth consecutive month to 4.3% in July. Despite new cycle highs in US manufacturing and construction employment, the pressure on the Fed to lower interest rates is immense to steer the economic development in a more positive direction. Should the conflict in and around Israel cool down, interest rates lower, policy certainty increase, and the semiconductor sector experience a cyclical upswing, the end of 2024 and all of 2025 could see positive developments for the North American manufacturing industry.

Europe

The EU as a whole (light-red line) has been in the recession zone of industrial production, with rates mostly below -5% over the past 12 months. Germany, which hosts the largest industrial sector among European economies, is leading this downward trend with an M-PMI reading of just 43.1 in July and an average reading of 42.5 over the past year.

Following the recent general election in France, where the left-wing NFP won a slight majority, France is prone to instability with a policy gridlock despite the urgent need for political reforms. Concerns about the leftists’ impact on public debt and hence the Euro currency have caused the Euro and the CAC 40 stock market index to decline, while French government bond yields increased immediately after the election results. Additionally, the French M-PMI approached the detrimental levels seen in Germany in July, indicating a negative outlook for the Eurozone’s second-largest economy.

On a more positive note, Spain and the UK are the only larger economies in Europe with growth-indicating M-PMI readings for at least the three months from May to July 2024. Spain’s industrial production also showed a substantial year-on-year increase, rebounding from a relatively weak 2023.

Japan and Korea

In March 2024, the Bank of Japan ended its policy of negative interest rates after eight years, while Japan’s public debt reached 238% of GDP amid an overaged population. The volatile Japanese Yen appreciated by around 10% against the USD in July alone, though this gain is insufficient to counteract its devaluation of up to 29% since March 2022. Such volatility not only has detrimental effects but also creates uncertainty, dampening investment activity. Japan’s industrial production (dark green line in Fig 1 and Fig. 3) plummeted by -7.3% in June, with an average decline of -3.28% in the first half of the year. The Manufacturing PMI bottomed out at 47.2 in February 2024. Although sentiment has generally improved since then, it only entered growth territory once, in May. Automotive production volume fell by more than 10% year-on-year in H1 2024, though there are early signs of an upswing in semiconductor manufacturing equipment.

In contrast, South Korea (light-green line in Fig. 1 and Fig. 3), which traditionally accounted for just under half of Japan’s sales volume in Machine Vision components sales, presents a more optimistic picture. Industrial production surged by 12.9% year-on-year at the start of 2024, led by automotive manufacturing, and maintained its growth trajectory throughout the first half of the year. Since May, South Korea has led the M-PMI ratings of Machine Vision’s primary target markets, with readings well above 51. With inflation nearing the 2% mark and an uptick in domestic consumption, the Korean economy appears to be leading over all G7 countries in recovering from the post-COVID turmoil.

India and Southeast Asia

India’s (green line in Fig. 2 and Fig. 4) industrial production growth averaged a robust 5% in H1 2024, supported by consistently positive sentiment among purchasing managers, with M-PMI readings ranging between 55 and 59 over the past 25 months. However, Prime Minister Modi’s ability to implement pro-economic policies has been complicated by a diminished majority following June’s general election. The much-anticipated reform of the Indian legal system now seems less likely, potentially hindering accelerated growth. Nevertheless, the relocation of production capacity from China remains a key driver of the boom in India’s manufacturing sector.

Automotive manufacturing is a cornerstone of Indonesia’s economy and labor market. Yet, in the first seven months of 2024, automotive production volume plummeted by 18.5% to 666,000 units. Initiatives like Subang Smartpolitan aim to boost manufacturing automation in Indonesia and beyond, particularly in automotive production, laying the groundwork for increased use of Machine Vision technologies. Simultaneously, Foreign Direct Investments, largely directed towards local manufacturing facilities, increased by 16% year-on-year in H1 2024. We expect the manufacturing sector in this country of 270 million people to expand in the coming years.

Thailand’s politics are in turmoil, the Philippines are struggling to develop a maritime oil field crucial for their energy supply amid disputes with China, and the potential annexation of Taiwan by China remains a matter of military success and economic risk. With a poor 2023, Taiwan recorded an average year-on-year industrial production growth of 10.5% in H1 2024, primarily driven by its chipmaking activities. Southeast Asian countries with political stability, such as Vietnam, Malaysia, and Singapore, also show positive sentiment scores and solid growth rates in their manufacturing output, offering great opportunities for cost-effective, easy-to-use Machine Vision technologies.

Short- and long-term strategies for Machine Vision players

In the absence of growing end-user consumption, the lack of skilled workers, increased labor costs, and expanding quality and profitability requirements continue to drive manufacturing automation and, consequently, machine vision sales. The purchasing power of average citizens in many developed countries is gradually eroded by inflation, political policies, and public debt, leading to long-term dampened consumption.

Today’s developing countries, which will be home to over 6 billion people by 2050, are and will continue to be the primary drivers of global growth in end-user consumption. These consumers are beginning to improve their living standards with low-cost products that need to be produced as cost-effectively as possible. Over the coming decades, the demand for products of higher quality, complexity, and value will grow.

Ambitious Machine Vision component and solution OEMs can benefit from these market developments with cost-optimized designs and a focus on applications with clear business cases in these countries.

Would you like to learn more about market trends by country or the developments in specific industries?

The team for Machine Vision market research Vision at Vision Markets is happy to support you with custom analyses. We answer crucial questions and help you design winning business strategies based on your technology stack, market access, and growth targets. Reach out to us now!

Don’t miss our future market updates and be the first to receive them!

Subscribe to our VisionCrunch business newsletter today!