Will the Food Industry Drive Growth for Machine Vision Players in 2024?

The global agriculture and food industry employs over 1 billion workers and faces the challenge of feeding 10 billion people by 2050. Price pressure, regulatory requirements, and labor shortage make the food industry one of the most important application areas for Machine Vision technologies. According to Vision Markets’ latest report of the Machine Vision components market, the food industry surpassed the revenue mark of 1 billion USD with Machine Vision components in 2022 for the first time.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. The author is not a registered investment advisor and is not affiliated with any brokerage or investment firm. Investing in the stock market involves risk, including the loss of principal. Readers should conduct their own research and consult with a financial advisor before making any investment decisions.

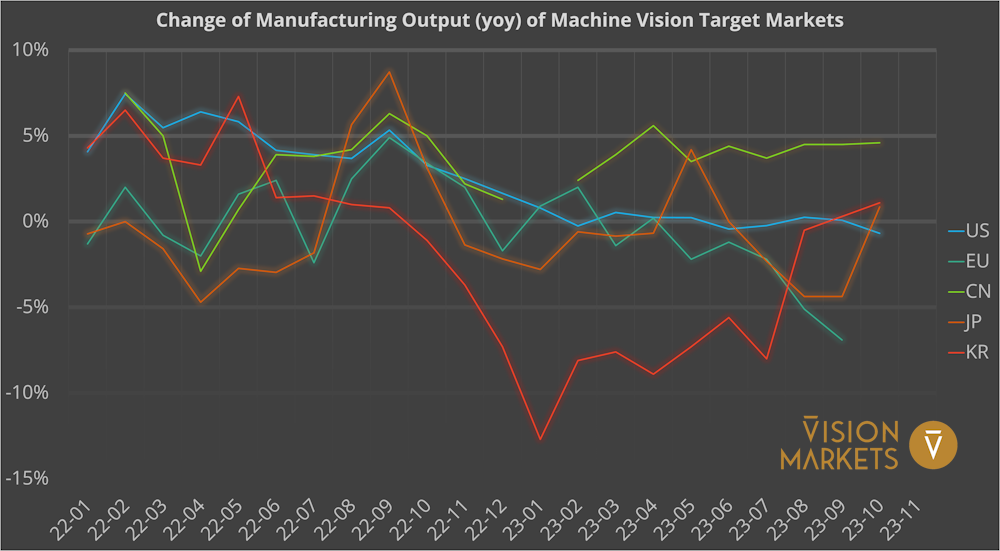

Calling 2023 a bumpy road appears to be a rather euphemistic label from the perspective of quite some Machine Vision players. The Manufacturing Output of the G7 countries entered a major recession (see Fig. 1) and the recently published October data did not spark any optimism for changing this trend.

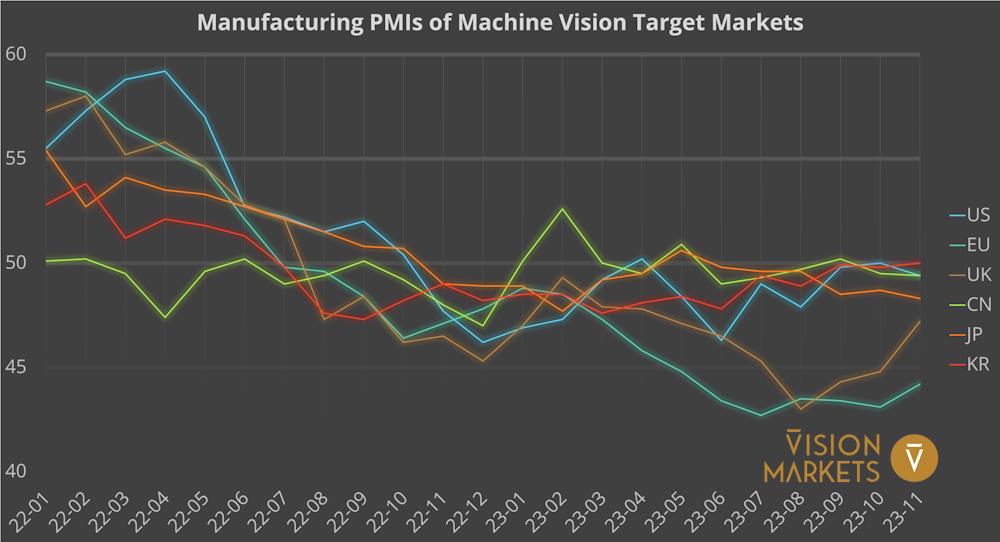

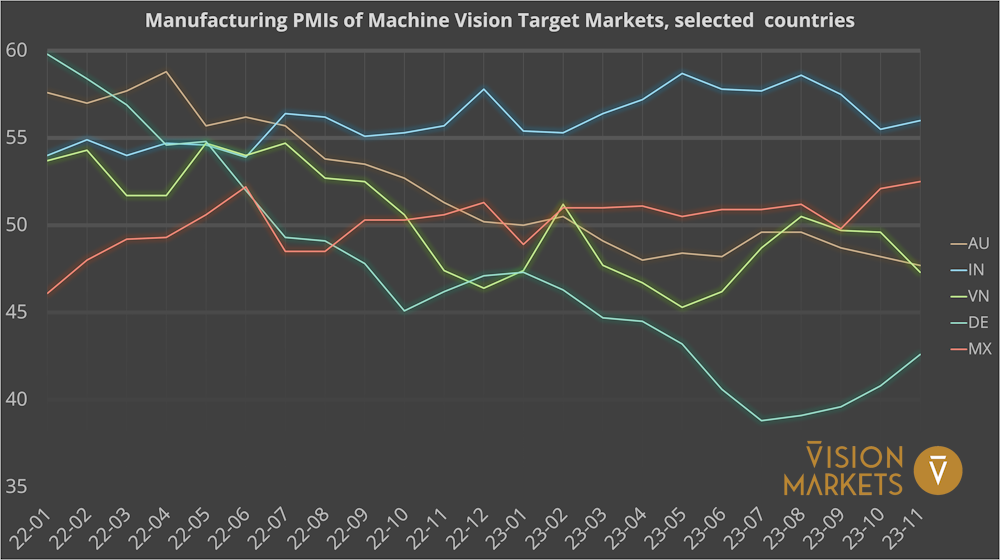

The forward-looking economic indicators of Manufacturing PMIs by country remained in the contraction area below the 50-points line for the majority of 2023 (see Fig. 2). Europe’s PMIs point towards a remarkable recession in the secondary sector with Germany (see Fig. 3) leading the downward trend.

China, the Factory of the World, is the largest single market for Machine Vision since 2022. However, the source-domestic policy of the ruling party favors domestic suppliers at the expense of foreign players. Economic and political tensions have prompted western companies to relocate factory sites to “ROW” countries. Fig. 3 shows the positive mood of purchasing managers in India throughout 2022 and 2023. In October and November, also the M-PMI for Mexico brightened the outlook into 2024, while the mood in Vietnam was dragged down by the economic turbulences of its neighbor and biggest trade partner in the north.

If you would like to learn more about the indicators discussed herein, like the year-over-year (YoY) Change of Manufacturing Output or the Manufacturing Purchasing Manager Index (M-PMI) please refer to the section About our Indicators and Regional Market Segmentation of our August market update.

Please also refer to the market research activities of Vision Markets or our flagship Market Report of Machine Vision Components with detailed analyses of the machine vision component revenue by product type, economic region, target industry, and their combinations.

What are the Upcoming Business Opportunities in the Agriculture and Food Industry?

Food producers can be seen as end-users of automation technologies such as machine vision. In this highly consolidated market, ten giant enterprises dominate the global landscape with an annual revenue of 0.5 trillion $ and a forecasted nominal (i.e., not inflation adjusted) growth of 10% in 2023. Nestle alone will contribute 100 bn$.

However, their profitability suffered recently, especially from increased energy and labor costs. Furthermore, supply issues from declining crop yields attributed to climate change and Russia’s invasion in Europe’s breadbasket Ukraine have led to higher expenses. Still, companies like Coca Cola stand out with an operational profitability north of 30%. The financially strong companies with billions of dollars of quarterly earnings have realized already in the 2000-years that Automation and Machine Vision provide them with competitive advantages. Most of them have built in-house resources and top-notch Machine Vision expertise for enhanced food processing, quality control, and packaging. Hence, these companies specify or even develop their own vision systems today.

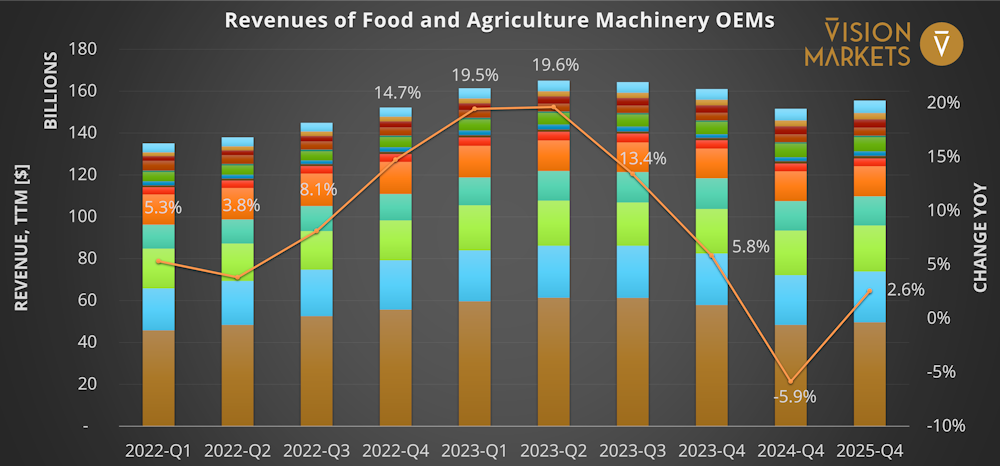

The sector of machinery for agriculture and food production, however, is far more fragmented. Fig. 4 shows the aggregated 12-month revenues of the top-13 OEMs of agricultural machinery as well as machinery for food and beverages summing up to 164 bn$ in the period ending Q2 2023. The Q4 values for 2023 to 2025 are analysts’ estimates.

While the manufacturing industry in G7 countries and beyond faced a downswing in 2023, the agriculture machinery and food machinery industry will show a combined annual growth of 5.8%. The forecast for 2024 is rather heterogenous for the two segments. The tight monetary policies of central banks with higher-for-longer interest rates are curbing the appetite to invest into high-value agriculture equipment. This leads to an estimated YoY decline in revenues by 9% in 2024 while the revenues of food machinery OEMs should grow by 3 to 5%. Hereby, the German Krones AG leads the estimations among the monitored enterprises with a 9+% growth.

Growth Driven by the Market, Innovation, and Subsidies

The food industry is the biggest employer, globally, and still doesn’t find enough workers, at least in the western hemisphere. A growing world-population calls for more output and higher productivity. Fierce competition and consumer wallets tightened by inflation require maximum yield and cost savings. Stricter regulations on allergens and pollutants as well as consumer expectations on esthetics and the preservation of healthy nutrients call for strict quality assurance measures.

One of the key solutions to these challenges is Industrial Automation, which uses various methods to enhance the processes of the food industry. Machine Vision is one of the most versatile and powerful methods, as it uses cameras, sensors, and artificial intelligence to perform a variety of tasks, such as:

- Vision-guided robots for the reduced application of weed killers, pesticides, and fertilizers and for harvesting.

- Autonomously driving tractors based on cameras, lidar, radar, and GPS navigation.

- Sorting and grading systems that can inspect bulk products using multi-spectral or hyperspectral imaging, or geometric gauging.

- 3D vision guided robots that can cut meat and package products with precision and speed.

- AI-vision based anomaly detection and quality inspection that can identify defects and contaminants in grain, fruits, vegetables, bakery products, etc.

When they meet the expected price point of the cost-sensitive food industry, these technical innovations will enable impressive growth rates in the coming years. For example, six studies from different research agencies expect the market for Agricultural Robots to grow at a compound annual growth rate (CAGR) of 19 to 35% from 2021 to 2026, reaching a value of 9 to 20 bn$ by 2025.

The market for such advanced agriculture and food processing techniques is not just limited to the western world. Emerging countries with a freaking growth of population also see the need to increase their productivity in this area. India, for example, has launched a Production-Linked Incentive Scheme for the Food Processing Industry (PLISFPI) worth 109 bn INR (~1.3 bn$) of subsidies to generate an additional output of food at a value of 4.0 bn$ to feed the Indian population but also for export.

Innovative Machine Vision technologies are a game-changer for the food industry, as they improve the efficiency, competitiveness, and profitability of the entire food industry.

Vision Markets analyzes the food industry as part of its continuous market research activities including its key players, emerging applications, start-up companies, and investments. Please contact us for further information and opportunities for your business.

Getting prepared for the future

Despite all economic concerns, the need for yield, quality, flexibility, and cost-cutting drives manufacturing automation across the globe. The Industrial Production Outputs and Manufacturing PMIs are important data points but just a small part of over 100 economic indicators, industries, and companies that Vision Markets is constantly including in its continuous analysis of the machine vision market. Especially for business planning for the next fiscal year and further strategy development, the unique market insights by the researchers of Vision Markets provide data-driven decision-making support. Our team of business consultants consists of former CEOs and executives of major machine vision corporations. They facilitate the development and implementation of successful growth strategies for ambitious machine vision players.

Don’t miss our future market updates and be the first to receive them!

Subscribe to our VisionCrunch business newsletter today!