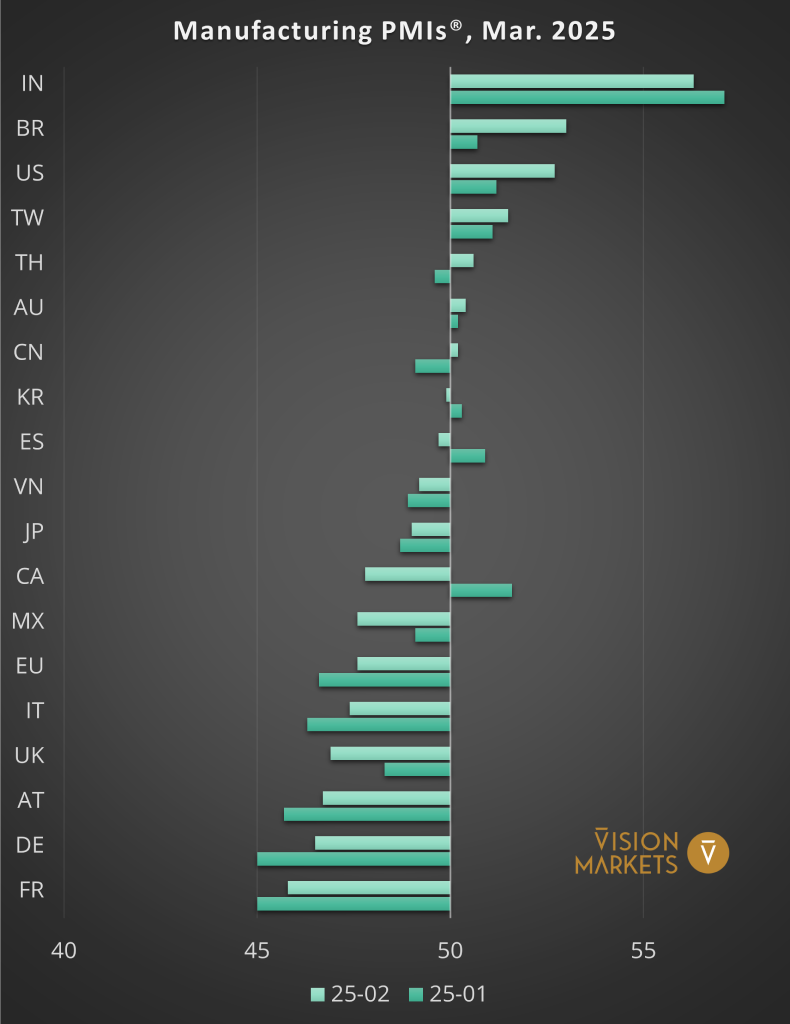

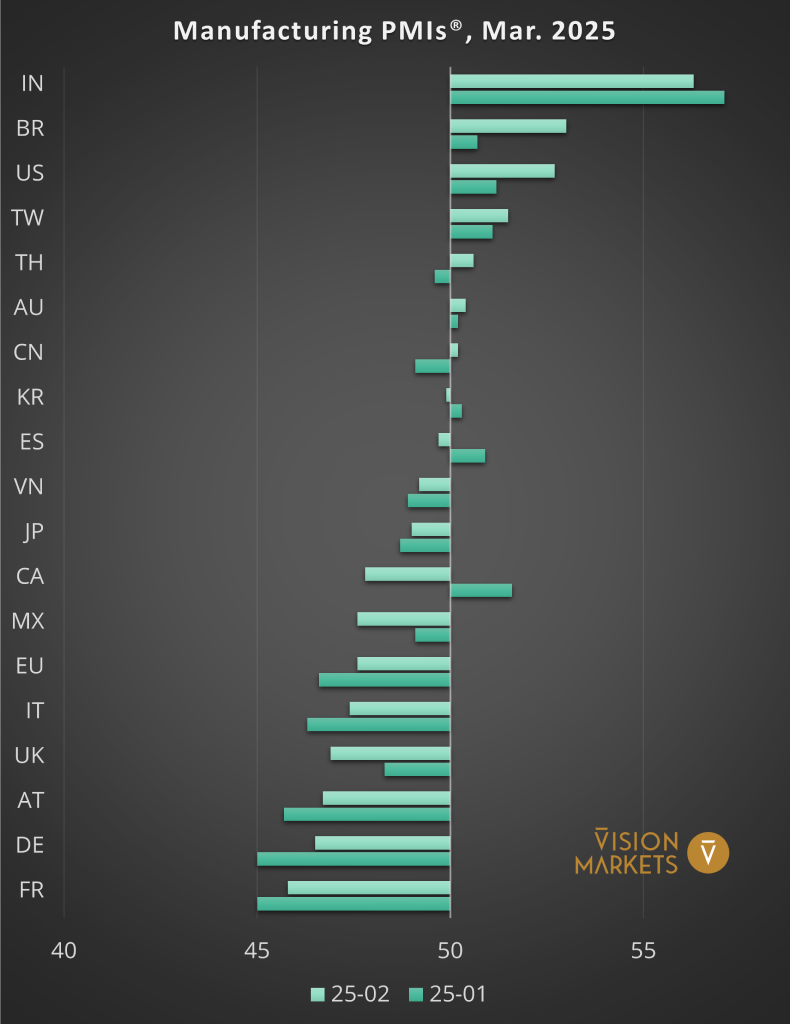

Despite the stock market sell-offs on Monday, March 10th, the latest global Manufacturing PMI (M-PMI) data shows significant improvements in the mood of the industrial sector throughout the world, with few exceptions like Canada and Mexico.

The US M-PMI strengthens to 52.7 as leaders are expecting an improved positioning of the US industrial sector under Donald Trump. Brazil climbed to become #2 in our ranking while India (56.3) remains the leader, though slightly moderating.

Followers of our social media profiles and members of our VisionCrunch community, are already familiar with the economic indicators we use to monitor the manufacturing industry by country. If you are not, please check out this explanation of Manufacturing PMI and year-over-year change in Industrial Output.

Purchasing Managers’ Index™ and PMI® are either trademarks or registered trademarks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

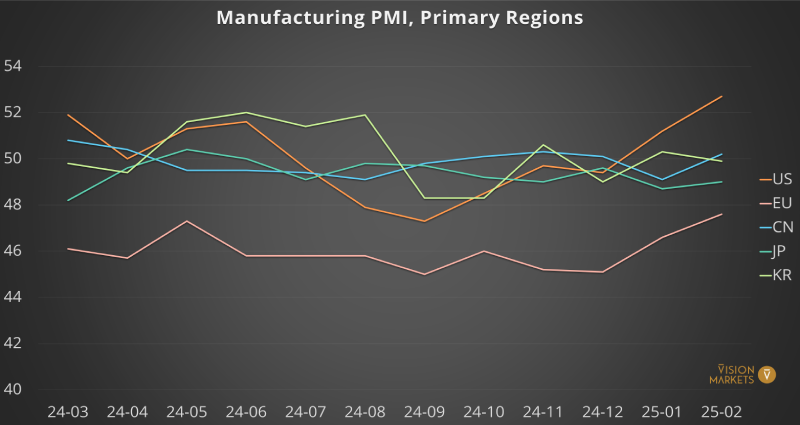

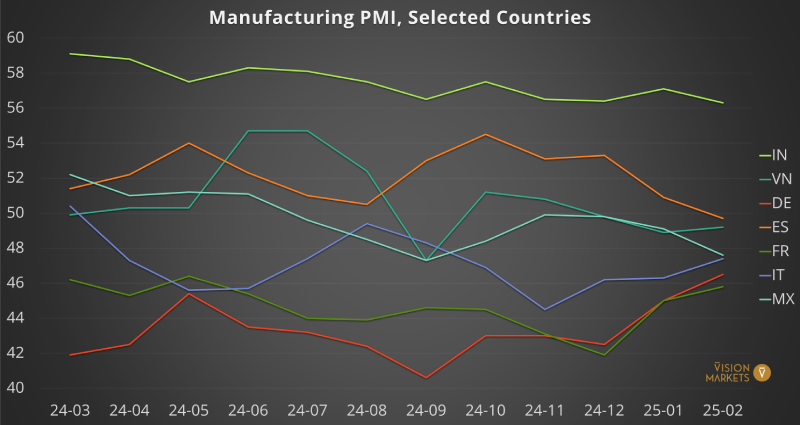

Europe continues to struggle, with Germany (46.5), France (45.8), and Italy (47.4) still in contraction yet on slightly eased levels as the whole of the EU. Even in Spain, Europe’s former cathedral of hope and growth, the mood has now dropped to contraction territory. The UK reported a 14-month low amid the greatest job losses since 2020, with new orders falling at steeper rates.

In Asia, China edges back into expansion, but concerns linger over customer demand. The growth target of 5% and announcements of stimulus packages of the governing party spark cautious hopes for improvement among industrial business leaders. Korea is mostly muted while Japan continues its slowly descending trend. Taiwan stays positive and the mood in Thailand and Vietnam was also brightening up in February.

With imminent US trade tariffs, manufacturers in Mexico (47.6) and Canada (50.2) fear detrimental impacts.

Views on the year-over-year rates of the industrial output for December 2024 show the US back in growth territory 0.55%. China strengthens, climbing to 6.2%, signaling steady growth, at least per such numbers provided by the Chinese government, which contradict privately polled sentiment scores. Europe remains under pressure as Germany and the broader EU struggle with ongoing declines. Japan improves, while Korea rebounds sharply (from 0.1% to 5.3%), reflecting volatile demand shifts. Italy’s downturn deepens to -7.1%, and Mexico continues to contract to -2.7%. As global supply chains adjust, the next quarter will be crucial in determining whether this momentum holds or falters.

India remains the strongest performer, holding around 5% growth, though slightly moderating in December. Spain rebounds to 2.1%, returning to expansion, while Germany (-2.4%) and the broader EU (-2%) remain in contraction.

To allow for some retrospective, we also offer the Manufacturing PMI readings of the last 24 months. Again, for better readability, we separate the charts into primary target regions of machine vision and selected countries. The charts show the indicator readings for the last 24 months.

If you would like to learn more about our perspective on the global target markets of Industrial Automation and Machine Vision, please contact us.

We provide you with a dedicated page where you will always find the latest available readings of Manufacturing PMIs and the Industrial Output of the target countries of Machine Vision suppliers.

Don’t miss our future market updates!

Subscribe to our VisionCrunch business newsletter today!