This market update comes later in the month in order to include the latest market data from Q3 2023 allowing for a more grounded forecast for 2024.

If you would like to learn more about the discussed indicators like the year-over-year (YoY) Change of Manufacturing Output or the Manufacturing Purchasing Manager Index (M-PMI) please refer to the section

About our Indicators and Regional Market Segmentation of our August market update.

Please also refer to the market research activities of Vision Markets or our flagship Market Report of Machine Vision Components with detailed analyses of the machine vision component revenue by product type, economic region, target industry, and combinations of these.

United States of America: Recovery underway?

After growing by 2.9% year-on-year in 2022 (OECD), the US manufacturing output (blue line) has been hovering around zero growth since early 2023, with a slight downward trend. The September reading was the second positive one in a row, but it did not indicate any change in the trend, at only 0.08% growth. The US Manufacturing PMI also confirmed the stagnation of industrial activity, with 49.8 points in September and a preliminary reading of 50.0 for October. On a positive note, manufacturing capacity utilization rose by 0.2% to 79.7% in September, matching its long-run average from 1979 to 2022.

However, the overall US economy delivered the strongest quarter-on-quarter GDP growth of 4.9% (seasonally and inflation adjusted) in two years in Q3, thanks to consumer spending defying higher prices, rising interest rates, and widespread recession forecasts. The US labor market is extremely strong, leading to an unemployment rate below 4% for 20 consecutive months. Consumers’ mortgages as well as a good share of corporate mortgages have fixed and favorable interest rates. Thus, the impact of the FED‘s rate hikes will only fully materialize when those mortgages are due and need to be refinanced with new contracts.

For 2024, The Economist‘s market intelligence unit predicts a GDP growth of less than 1% for North America, which would be the lowest growth among all economic regions. Wall Street’s common sense, however, points more towards a mild recession in 2024, driven by tighter monetary policies fighting the inflation and wage spiral as well as the trade tensions with China and the detrimental impacts of global warming. The US GDP depends on consumer spending by 70%. Hence, a recession in the national GDP does not necessarily imply a recession in industrial output, considering the re- and near-shoring initiatives of supply chains supported by Bidenomics with its US CHIPS Act (analysis by PwC) and Inflation Reduction Act (analysis by McKinsey).

Investments into the construction of factories boom throughout the US at a 30-year high. Here you can find a map of commercial construction activities in semiconductor plants, EV plants, and other manufacturing facilities. These activities raise expectations for an upswing in the Automation and Machine Vision investments in the US manufacturing industry against mid-2024.

European Union:

Pessimistic outlook, still

The recession of the manufacturing industry in the EU (cyan line), especially in Germany, is worsening. The EU manufacturing output plunged to -5.1% in August, the lowest level since the 2008-2009 financial crisis. The M-PMI, which measures the activity of purchasing managers in the manufacturing sector, stabilized slightly above its July low at 42.7 but remained at a devastating 43.4 for September. These five months with readings below 45 indicate a long-term and severe downward trend.

Germany, which is expected to become the world’s third-largest economy in 2023 overtaking Japan, is suffering from multiple factors that are hurting its manufacturing sector. Some of these factors are: China’s efforts to reduce its dependence on foreign technologies and increase its domestic production; the trade tensions and tariffs imposed by the US; the environmental regulations and policies that require a transition to cleaner and more efficient technologies; and the lack of skilled workers and digitalization in most industries. Eventually, the German association VDMA reported a YoY decline of -16% in machinery orders from June to August 2023, wherein orders from the Eurozone fell behind by -14%.

Industrial players such as Dürr AG revised their earnings forecast for 2024 following a -32% downturn in order intake, especially for woodworking machines. The pan-European Machine Vision component distributor and solution provider Stemmer Imaging adjusted its revenue forecast to a level below 3-7% compared to its previous fiscal year.

Besides Manufacturing, which is our focus in this economic trend series, the Logistics sector in Europe is suffering. In Germany alone, e-commerce revenues dropped by 14% in Q3 2023 YoY.

China: Great Potential – Hard to Tap

Since 2022, China (green line) is the largest single target market for machine vision components (Source: Annual market report Machine Vision Components 2017 to 2027).

Unlike the other economies here, China’s manufacturing output has remained well in positive territory throughout 2023. According to official figures, the manufacturing output grew by 4.5% in both August and September 2023. On average, growth will be between 4 and 5%, despite China’s huge manufacturing GDP in the denominator. The “Made-in-China” policy makes it increasingly difficult for non-domestic vendors to benefit from this growth, as domestic suppliers are favored. Moreover, as economic and political relations are worsening and the fear of an invasion of Taiwan rises, western giants in semiconductors and electronics are relocating production sites to India, Thailand, Vietnam, Singapore, and other “ROW” countries – see below.

Japan & Korea:

Waiting for the Semiconductors Industry

The manufacturing output of South Korea (red line) is still in negative growth territory, but it showed a significant and surprising jump to -0.5% in August, from -8% in July. Korea’s defense industry benefits from large orders from NATO countries in their support of Ukraine against Russia. However, Asia’s fourth-largest economy is struggling with weak demand in its core export markets, especially in Europe

Vision Markets’ quarterly monitor of the top OEMs in Semiconductor Manufacturing Equipment reported their revenue to be 15.3 billion USD in Q2 2023, which constitutes a decline of -8.5% year-on-year and -4.8% quarter-on-quarter. Korea, with its exposure to the semiconductor industry, is suffering from its current weakness. Yet, the SEMI association reports that the semiconductor industry bottomed out at the end of the first half of 2023, and has since started a recovery, setting the stage for continued growth in 2024. All segments are projected to log year-on-year increases in 2024, with electronics sales surpassing their 2022 peak.

Japan (orange line) is seeing its Manufacturing PMI decline to 48.5 in September. Japan’s key manufacturing industries are expected to grow by 1.8% in 2023, mainly supported by Automotive and Medical products growing between 2.2 and 2.5%. The total for 2024 is said to be in a similar range, but the long-term outlook shows a continued deceleration of growth in industrial manufacturing. The Japanese yen has lost about 13% in valuation against the US dollar since the beginning of 2023, as a result of Japan’s struggling economy and different monetary policies. The reduced costs of products from Japan can hardly compensate for the fact that China’s OEMs and users have turned into competitors rather than customers for Japanese companies.

Rest of World (RoW):

Opportunities in Southeast Asia

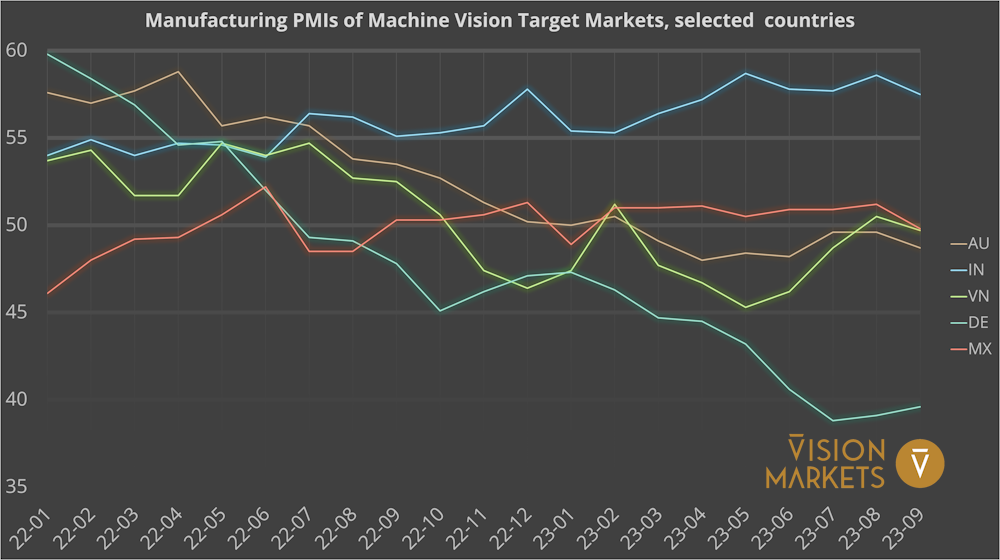

Purchasing managers of manufacturers in the emerging markets have lost a bit of confidence since our last report in August. But let’s take a look one by one.

Mexico is coming from a growth in Manufacturing GDP of 5.2% in 2022 vs. 2021. Since September 2022, Mexico’s M-PMI readings were all slightly above 50, except for January this year. This resulted in a growth of 2.7% in industrial production output, approximated by the average monthly YoY trend in H1 2023. The average M-PMI reading of 50.6 in 2023 was undercut by a drop to 49.8 in September dropping into the contraction area correspondingly. Despite all the billions of USD investments by automakers and heavy industry into new factories, Mexico is dependent on the demand for goods of its big neighbor in the north. As described above, the US manufacturing industry is shaky with detrimental effects on Mexico’s OEMs.

Vietnam contributed an added-value manufacturing output of 90 bn$ in 2021 and as such it is a tiny player in global terms. Being the closest emerging market to China, Vietnam attracted billions of manufacturing investments beyond its traditionally strong textile industry. Vietnam’s M-PMI showed high volatility in H1 2023 coming from positive territory in 2022 declining to its lowest reading of 45.3 in May. It recovered to a flat to growth-suggesting reading of 50.5 in August but dropped slightly back below the neutral 50 points line in September. China is the second largest export destination of Vietnam, thus, the weakness of its northern neighbor harms manufacturing activities.

Furthermore, Vietnam is known for its manufacturing capacities of rather low-cost consumer goods. Globally, and especially in Europe, consumer spending is contracting. As Vietnam’s power and transportation infrastructure keeps improving, Machine Vision players are witnessing growing demand to automate all the new factories being built.

For detailed insights in Vietnam’s current and future role as manufacturing hub, McKinsey’s recent report

Boosting Vietnam’s manufacturing sector: From low cost to high productivity

provides valuable clues.

India‘s purchasing managers of manufacturers are among the most enthusiastic when it comes to near-term growth. Despite the drop to 57.5 in September from close to a record-high 58.6 in August, the Indian manufacturing industry is growing the fastest among all economies in Southeast Asia in absolute terms. With a population of over 1.4 billion and a growing per capita GDP of 2,257 USD in 2021, India features a large domestic market, low labor costs, and a well-educated workforce. Players like Cognex, Edmund Optics, and OPT Machine Vision, have set up their own marketing, sales, and support centers in India. German sensor OEMs Wenzel Group and Schäfter+Kirchhoff has just recently opened R&D centers and manufacturing facility in India showing the growing importance of this region for Machine Vision players.

Getting prepared for the future

Despite all economic concerns, the need for yield, quality, flexibility, and cost-cutting drives manufacturing automation across the globe. Industrial Production Output and Manufacturing PMI are important but they are only a small part of over 100 economic indicators and companies that Vision Markets is constantly including in its continuous analysis of the machine vision market. Especially for business planning for the next fiscal year and further strategy development, the unique market insights by the researchers of Vision Markets provide data-driven decision-making support. Our team of business consultants consists of former CEOs and executives of major machine vision corporations. They facilitate the development and implementation of successful growth strategies for ambitious machine vision players.

Don’t miss our future market updates and be the first to receive them!

Subscribe to our VisionCrunch business newsletter today!