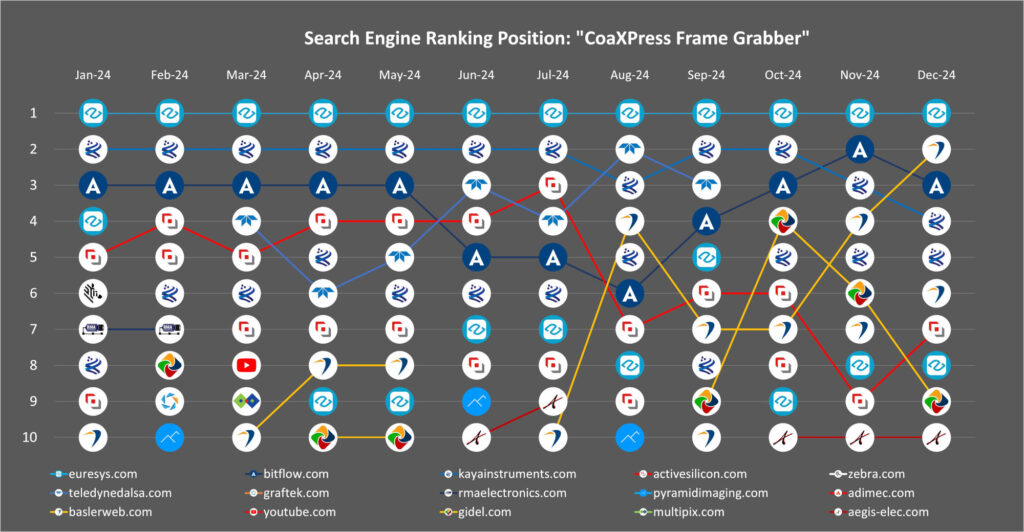

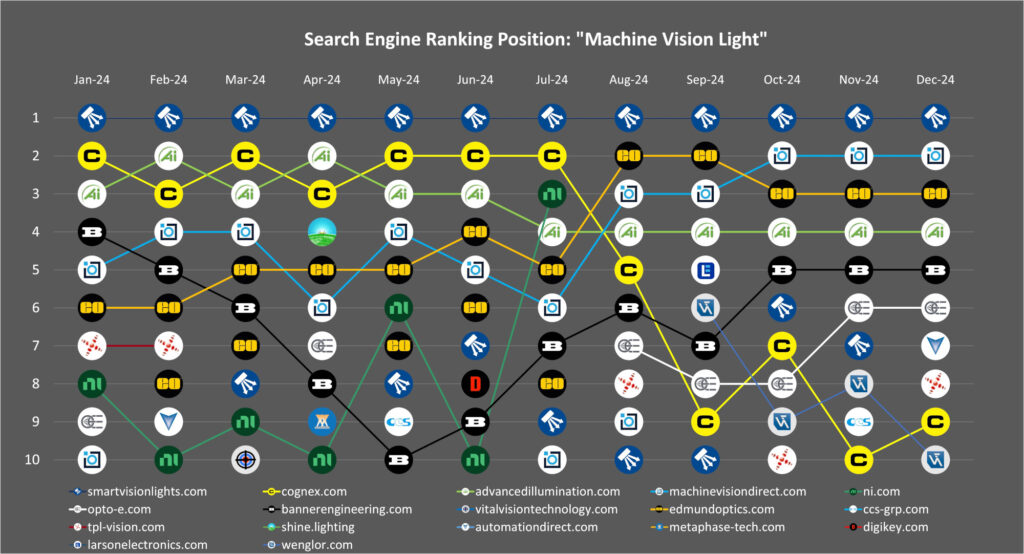

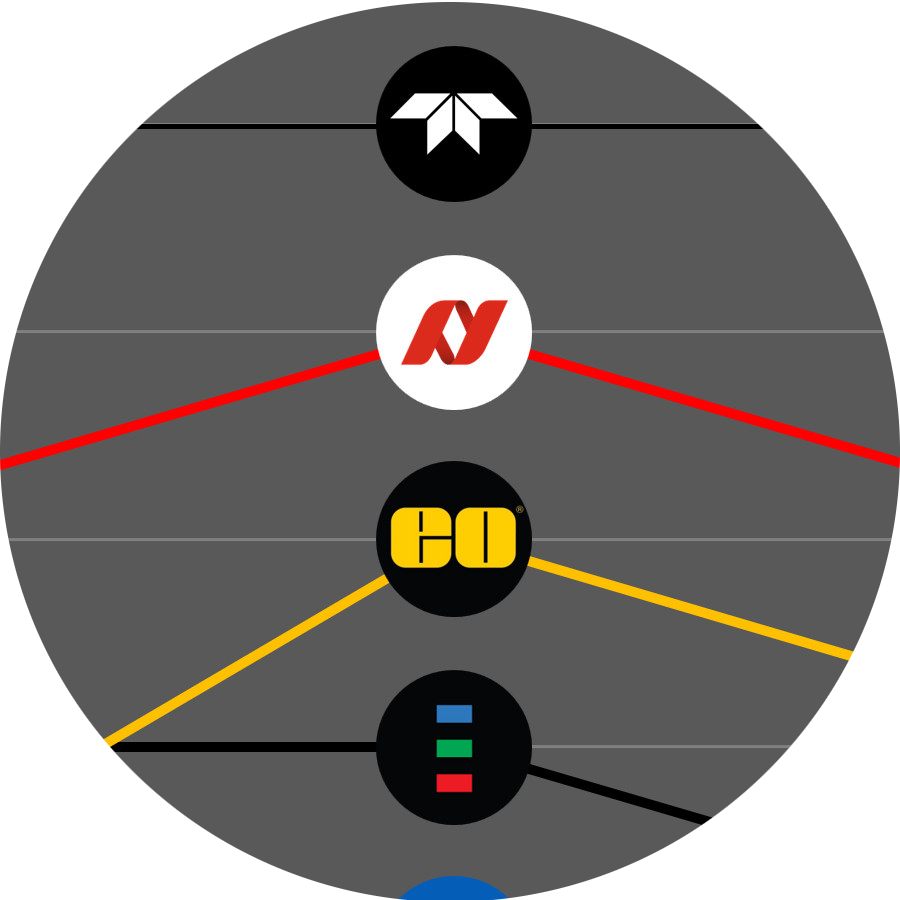

Vision Markets’ Search Engine Ranking Position report for CoaXPress framegrabbers shows a spectacular progression for Basler and a consolidated performance of Gidel and Aegis.

At Vision Markets, we constantly monitor search engine ranking positions (SERP) of our clients’ websites and their competitors’. In the frame grabber market, specific keywords such as “CoaXPress frame grabber” are needed to avoid confusion with frame grabbing software tools in video editing. Our SERP report for “CoaXPress frame grabber” gives an indication of the top players in this market segment.

Disclaimer:

The chart above shows the organic search results for the keyword “CoaXPress frame grabber” in Google.com in the US. They may not reflect results in other countries or Google’s personalized search results based on individual user behavior. This reports only gives a general indication of the search engine power of websites and brands for this specific keyword.

Bitflow.com back in the top 3

Bitflow.com had been in the top 3 for many months but dropped down to rank #6 in Q3/2024. This might have been due to Bitflows acquisition by Advantech, although the company kept the bitflow.com domain. In Q4/2024, bitflow.com is back in the top 3, even reaching rank #2 in November.

Basler jumps from rank #7 to #2

Baslerweb.com had not been systematically part of the top 10 rankings until July 2024. Since then, however, the domain has progressed spectacularly, reaching rank #2 in December. Basler even ranked two pages in the top 10 results in November and December.

Kaya Instruments, who had been a regular #2 since the beginning of the year, drops to rank #4 but remains a strong player with two pages ranking in the top 10 results.

Gidel and Aegis are here to stay

Gidel had appeared sporadically in this chart but has now been there for four months in a row, with a spike on rank #4 in October, its best-ever performance. Although the Israeli company dropped down in Q4, its position in the top 10 seems more solid than it used to be.

The same applies to Aegis. The US-based distributor of machine vision products had made first appearances in mid-2024 but now settled on a steady rank #10 in Q4. Will it be able to keep this position in the long run? Subscribe to our newsletter to get regular SERP updates per email!

Don’t miss upcoming updates of our SERP report!

Subscribe to our newsletter!

How is your domain ranking?

How is your website ranking for your target keywords? How do you compare with your competitors? We can help you monitor and improve your performance with SERP reports tailored to your strategy and SEO recommendations to improve your ranking position. Contact us today!